Despite gold's recent run up to new historic highs, I believe the yellow metal's price has far to go - both in future percentage appreciation and duration before the great gold bull market comes to its ultimate cyclical end.

Right now, there is no evidence of a buying frenzy to suggest we are anywhere near a long-term top . . . but there are plenty of rock-solid fundamentals that suggest the market is healthy with plenty of room to move higher. Moreover, the world economic and geopolitical environment remains very supportive - and seems likely to remain pro-gold for years to come.

My forecast, published onNicholsOnGold and in other speeches and reports, of $1700 gold by year-end 2011, now seems within easy reach.

And this is just the beginning of gold's next great leap upward, a leap that will carry the metal to $2000 an ounce in 2012 - with prices heading still-higher, quite possibly to $3000, $4000 and maybe even $5000 an ounce by the mid-to-late years of the decade.

From a long-term perspective, gold prices near $1500, should we ever return to that level, $1600, or even $1700 an ounce will prove to be bargains.

As I have cautioned in the past, expect high two-way price volatility and periodic sharp corrections, corrections that some will mistake as the end of the bull market - but consider these opportunities for "scale-down" buying, opportunities to acquire additional metal at bargain-basement prices.

A PAUSE THAT REFRESHES

Rising some $300 an ounce from its January 2011 low point and more than $120 in just the past few weeks, gold has scored a series of successive all-time highs. Now, however, there is certainly some risk of a sharp short-term correction, particularly if the political-economic news on either side of the Atlantic looks less threatening to financial market stability.

A political compromise to raise the U.S. Treasury debt ceiling and agreement to narrow the Federal deficit in future years that avoids any downgrading of Treasury debt by the rating agencies would remove or reduce an important source of anxiety that has contributed to gold's recent strength. News of positive movement toward or actual completion of an agreement could trigger a swift - but temporary - gold-price retreat.

Speculative long positions held by institutional traders on world derivative markets have increased sharply in recent days. Should the market lose upward momentum, speculative pressures could quickly turn negative. Moreover, if the short-term news turn bearish for gold, liquidation of these long positions and/or institution of new speculative short positions could leave the market especially vulnerable to a swift correction .

Adding to my short-term caution has been a price-related relaxation of physical demand and the appearance of increased quantities of gold scrap returning to the market, especially from India and other price-sensitive national markets in recent weeks as prices rose above $1550 and approached $1600 an ounce.

I expect Indian and Chinese scrap reflows will diminish significantly over time, even at high price levels. In the meanwhile, should gold approach or fall below the $1550 level, scrap supplies will quickly abate and price-sensitive demand, smelling a bargain, will re-appear.

HOT SUMMER, HOTTER AUTUMN

Contrary to the view expressed by most serious gold analysts, we said in past reports that gold would not pause for its typical summer vacation - and it hasn't! Nor would we see this summer a seasonal relaxation in price volatility. Indeed, it has been a very hot summer as gold moved up smartly to achieve new all-time highs with plenty of fireworks and price volatility both up and down.

However, come September, positive seasonal factors will kick in - and, other things being equal, give gold still more firepower. There are three distinct sources of seasonal demand, all of which will likely contribute to demand and higher prices as we move into the later few months of 2011: First, jewelry manufacturers step up fabrication demand ahead of Christmas gift-giving late in the year; second, Indian dealers begin stocking up ahead of the autumn festivals and wedding season, and in expectation of good harvests and healthy household incomes in the gold-friendly agrarian sector; and, third, later in the year and in early 2012, we should expect a sharp rise in gold investment and jewelry demand associated with the approaching Chinese lunar new year.

For sure, irrespective of the season, price-sensitive Asian demand - principally from China and India - for physical metal will continue to underpin these markets and limit downside risks.

So too will bargain hunting by a number of central banks eager to raise their official gold holdings without disrupting the world gold market by increasing upward price volatility.

CENTRAL BANKS REDISCOVER GOLD

Official statistics published monthly by the IMF show that central banks, as a group, have been busy buying gold. Russia, India, China, Saudi Arabia, Mexico, and Brazil have been among the big buyers in recent years and a number of other countries have added smaller amounts of gold to their official reserves. One big surprise was Mexico's purchase of some 100 tons earlier this year as a hedge against the possible decline in the value of their U.S. dollar reserve holdings.

Moreover, a recent survey of 80 central bank reserve managers predicted that the most significant change in their official reserve holdings in the next 10 years will be their intentional build up in gold reserves. They also predicted that gold will be their best performing asset class over the next year and sovereign debt defaults will be their principal risk.

OVEREIGN DEBT CRISIS PROMPTS SAFE-HAVEN DEMANDS

European Central Bank president Jean-Claude Trichet a few weeks ago raised the alarm level on Europe's debt crisis to "red," warning that the crisis is nowhere close to being resolved . . . and he also warned of the "potential contagion effects across the [European] Union and beyond."

Meanwhile, Europe's sovereign debt problems are worsening and the likelihood of sovereign default by one or another of the more vulnerable periphery economies is increasing, despite the past week's patchwork aid package that avoided (or more likely postponed) a sovereign default by Greece.

Despite all the talk among finance ministers and the European central bank, it looks like the future fate of "periphery' country debt is increasingly in the hands of the credit rating agencies who view any delay in full repayment as partial default.

Several factors suggest that the European debt crisis will continue to worsen:

Longer term, the more restrictive fiscal policies the periphery nations (Portugal, Ireland, Italy, Greece, and Spain - the so-called PIIGS) have been asked to accept will push their economies deeper into recession - and increase, rather than decrease, government deficits and borrowing needs for years to come.

More immediately, the downgrading of sovereign debt by the rating agencies raises interest rates and borrowing costs - and pushes these countries closer to the brink (a lesson that the United States needs to learn before it also finds itself with higher Treasury borrowing costs should we suffer a cut in our own debt ratings on U.S. Treasury securities).

As credit ratings decline for the peripheral countries, the rising cost of refinancing maturing debt make it all that much more difficult to keep their heads above water. Reflecting the recent deterioration in credit ratings, Greek two-year bond yields last week were over 35%, Spanish 10-year bonds hit a record 6.3%, and Italian 10-year bonds were also yielding around 6%. Higher borrowing costs will increase government deficits and make repayment of past debt all the more difficult.

An important aspect of the crisis is that default on European sovereign debt, debt that is held by many European banks, will require the banks to write-down these questionable assets, leaving them with insufficient capital and effectively bankrupt.

The broader effect of bank failures on the European economy, capital markets, and banking system could be far more devastating than the Bear Sterns and Lehman Brothers debacle in the United States - and would likely result in the European Central Bank along with the U.S. Federal Reserve flooding financial markets with newly created money, depreciating paper currencies, inflating prices, and boosting gold.

I continue to believe that ultimately the euro, Europe's single currency, will be replaced by a multi-currency system - with the core countries possibly retaining the euro while the periphery nations will revert each to their own monetary unit or a deeply devalued renamed euro of their own.

With no solution in sight, Europeans will continue to abandon the euro for "safe havens" including gold and, ironically, the U.S. dollar. At the same time, the problems of the euro will discourage its acceptance as a reserve currency by some central banks - and make gold an even more attractive alternative.

MEANWHILE, BACK AT THE FED

The U.S. economy is still mired in recession, or worse. Nearly everyone knows it, even if the official statistics show some positive growth in real GDP. Unemployment remains stuck at over 9 percent. The huge inventory of foreclosed homes held by banks continues to weigh heavily on home prices. Various economic indicators released in the past few days and weeks are pointing to the second dip in what may be called a double-dip recession.

So far, most Washington politicos and Wall Street bankers are in denial, refusing to see the worsening signs of renewed recession. Instead, they are arguing for restrictive economic policies that, if enacted, would exacerbate the developing downturn . . . and which future history books will liken to the policy mistakes of the 1930.

The Fed also fails to see, at least publically, the writing on the wall. Having ended its program of quantitative easing at the end of June as scheduled, it will - in my view - soon be forced by rising unemployment and sluggish business activity to resume monetary stimulus in one form or another. Contrary to popular belief, the Fed can stimulate the economy and liquefy the financial system through open-market purchases of securities and even real assets, not just Treasury securities but stocks, corporate bonds, commercial paper, mortgages, credit-card debt, student loans and even real estate.

The resumption of quantitative easing (QE3) or some other program of monetary stimulus will be reflected in a swift and significant jump in gold prices.

As I have said in past reports and speeches, the only viable and politically acceptable means for America to dig itself out of its unbearable burden of excess debt - federal, state and local, housing, and other private-sector debt - is to pursue a pragmatic policy of higher inflation that will deflate the ratio of outstanding debt to nominal gross domestic product (GDP) to historically acceptable and manageable levels. This is what we did in the 1970s, a decade of stagflation, and we're already doing it again. Indeed, under Chairman Bernanke's lead, the Fed is quietly pursuing this policy of targeting somewhat higher U.S. price inflation.

Pursuit of a mildly inflationary monetary policy will not however excuse the Congress and Administration from developing a responsible believable program of long-term spending restraint and deficit reduction. However, now is not yet the time to impose these restrictions on an ailing economy - though articulation of a realistic bi-partisan plan for long-run deficit and debt reduction would help calm world financial and currency markets.

Whatever happens in the U.S. and European economies, it is hard to imagine a realistic scenario that won't push gold prices significantly higher in the months and years ahead.

OTHER PRO-GOLD TRENDS CONTINUE

Meanwhile, other important pro-gold trends continue unabated. These bullish trends include:

The growth in Chinese, Indian, and other Asian gold demand accompanying their expanding economies, growing wealth, rising inflation, and historic affinity to gold in jewelry and as a saving and investment medium.

The expansion of the gold investment infrastructure around the world - such as the development of gold exchange-traded funds and other forms of physical gold . . . or the implementation of gold distribution systems through banks and other retail outlets in China, India, and elsewhere).

The recognition of gold as a worthy asset class for inclusion in investment programs and portfolios of individuals; pensions, endowments and other institutions; sovereign wealth funds; and central banks.

The relative stagnation of new gold-mine production (certainly in comparison to the growth in gold demand) and the rising costs of discovery, development, and operation of new mines.

http://www.mineweb.com

Wednesday, July 27, 2011

No Matter What… Buy Silver

By TaipanPublishingGroup.com

A lot of my friends are having kids right now. Over the weekend, we had some friends over for dinner. One of them brought his eight-year-old daughter. She loves animals, and was great with all our dogs and horses, but we ended the night exhausted! Explaining the rules, keeping a watchful eye over the bigger dogs, reminding her to use her inside voice... I'm still tired from the visit. And I can't begin to imagine how much harder it would be with two kids. Especially with the arguments, trying to decide who's right and who needs a time-out. The mainstream financial media is like a couple of eight-year-olds. We hear arguments from both sides -- corporate earnings are beating records, but at the same time joblessness could jump to 10% again. Which is it? And how do you plan an investment strategy against such bipolar predictions? Here at Smart Investing Daily, we believe the U.S. economy is at another tipping point. The recent market rallies are unsustainable, are similar to an extinction burst... You know, when a child is throwing a tantrum and he lets out one last big scream before he falls asleep. But in case I'm wrong, wouldn't it be nice to know of an investment that could make you profits if the market rises or falls? Well, I've got one for you...

Invest in Silver

Silver is an interesting precious metal. It protects against inflation like gold. But silver also has a lot of industrial uses. That makes it like copper, which booms during economic recoveries. One of the toughest aspects of gold is to find out if it's trading more as a currency or a commodity. Is gold demand up because of concerns about the debt crisis? Or is gold up because of jewelry demand in India and China? It's an important question, but one that doesn't apply in the same way to silver. Silver straddles the metals industry. Certainly, gold and platinum have industrial uses, and we like both of these precious metals as investments right now. Consider this, though. About a quarter of all platinum consumption came from recycled platinum. That's not the case with silver, and that could mean increased demand during an economic recovery. In fact, 487.4 million ounces of silver were used for industrial purposes in 2010. That's well over four times the amount of silver used to make coins and medals. That's also a gain of about 20% from 2009. Not bad in a struggling economy. With uses that span electrical circuits, water purification, photography and other industries, industrial silver demand makes up 66% of silver production. But there's another aspect of silver that should get your attention -- silver investments. World investment demand climbed 40% last year to more than 279 million ounces. And get this... Hedge funds and money managers increased their silver positions by 19% last week, according to the U.S. Commodity Futures Trading Commission... the third week of gains. (Don't forget to sign up for Smart Investing Daily and let me and fellow editor Jared Levy simplify the market for you with our easy-to-understand articles.)

How High Could Silver Prices Go?

Bloomberg reports that silver could climb as high as $70 an ounce by next March... a jump of almost 75% from current prices. Let's take a look at a chart to see if this is a realistic forecast.

View Larger Chart

This is a chart of silver futures for September delivery. See that pop from late April? A huge move... but prices fell short of silver's all-time high of $50.35 an ounce in January 1980. Since January 2011, silver prices have climbed 26%. That's not a bad gain; it beats gold's gain of 12% handily. But that's not near the pace silver would need to climb in order to meet a 75% gain by next March. Is it possible? Yes. Between September 2010 and May 2011, silver prices climbed 140%. But just as quickly, a huge chunk of that gain disappeared when silver prices dropped from $48 back below $35. Realistically, silver prices may test that all-time high by Thanksgiving. At that point, smart investors should ruthlessly protect their gains. That strong resistance silver shows around $50 an ounce will be tough to beat. Expect a drop in prices anywhere above $48. For investors considering an exchange-traded fund like the iShares Silver Trust (SLV:NYSE), look to the price spike in late April to find your resistance point. For investors looking at silver mining companies, be aware that mining costs, like fuel prices, impact profits. Keep an eye on operating margins as companies report earnings. Lower margins could mean lower earnings moving forward. Publisher's Note: Taipan's Michael Robinson is the best in the business when it comes to playing the silver market. So far this year, he has led American Wealth Underground subscribers to gains of 200%, 68%, 140% and 353%... all thanks to silver and the metals market. Michael recently unveiled his latest special report. There is a strong chance it will lead to his biggest gains yet. To learn what our silver expert has uncovered, follow the link.

Article brought to you by Taipan Publishing Group. Additional valuable content can be syndicated via our News RSS feed. Republish without charge. Required: Author attribution, links back to original content or www.taipanpublishinggroup.com.

Source: http://countingpips.com

A lot of my friends are having kids right now. Over the weekend, we had some friends over for dinner. One of them brought his eight-year-old daughter. She loves animals, and was great with all our dogs and horses, but we ended the night exhausted! Explaining the rules, keeping a watchful eye over the bigger dogs, reminding her to use her inside voice... I'm still tired from the visit. And I can't begin to imagine how much harder it would be with two kids. Especially with the arguments, trying to decide who's right and who needs a time-out. The mainstream financial media is like a couple of eight-year-olds. We hear arguments from both sides -- corporate earnings are beating records, but at the same time joblessness could jump to 10% again. Which is it? And how do you plan an investment strategy against such bipolar predictions? Here at Smart Investing Daily, we believe the U.S. economy is at another tipping point. The recent market rallies are unsustainable, are similar to an extinction burst... You know, when a child is throwing a tantrum and he lets out one last big scream before he falls asleep. But in case I'm wrong, wouldn't it be nice to know of an investment that could make you profits if the market rises or falls? Well, I've got one for you...

Invest in Silver

Silver is an interesting precious metal. It protects against inflation like gold. But silver also has a lot of industrial uses. That makes it like copper, which booms during economic recoveries. One of the toughest aspects of gold is to find out if it's trading more as a currency or a commodity. Is gold demand up because of concerns about the debt crisis? Or is gold up because of jewelry demand in India and China? It's an important question, but one that doesn't apply in the same way to silver. Silver straddles the metals industry. Certainly, gold and platinum have industrial uses, and we like both of these precious metals as investments right now. Consider this, though. About a quarter of all platinum consumption came from recycled platinum. That's not the case with silver, and that could mean increased demand during an economic recovery. In fact, 487.4 million ounces of silver were used for industrial purposes in 2010. That's well over four times the amount of silver used to make coins and medals. That's also a gain of about 20% from 2009. Not bad in a struggling economy. With uses that span electrical circuits, water purification, photography and other industries, industrial silver demand makes up 66% of silver production. But there's another aspect of silver that should get your attention -- silver investments. World investment demand climbed 40% last year to more than 279 million ounces. And get this... Hedge funds and money managers increased their silver positions by 19% last week, according to the U.S. Commodity Futures Trading Commission... the third week of gains. (Don't forget to sign up for Smart Investing Daily and let me and fellow editor Jared Levy simplify the market for you with our easy-to-understand articles.)

How High Could Silver Prices Go?

Bloomberg reports that silver could climb as high as $70 an ounce by next March... a jump of almost 75% from current prices. Let's take a look at a chart to see if this is a realistic forecast.

View Larger Chart

This is a chart of silver futures for September delivery. See that pop from late April? A huge move... but prices fell short of silver's all-time high of $50.35 an ounce in January 1980. Since January 2011, silver prices have climbed 26%. That's not a bad gain; it beats gold's gain of 12% handily. But that's not near the pace silver would need to climb in order to meet a 75% gain by next March. Is it possible? Yes. Between September 2010 and May 2011, silver prices climbed 140%. But just as quickly, a huge chunk of that gain disappeared when silver prices dropped from $48 back below $35. Realistically, silver prices may test that all-time high by Thanksgiving. At that point, smart investors should ruthlessly protect their gains. That strong resistance silver shows around $50 an ounce will be tough to beat. Expect a drop in prices anywhere above $48. For investors considering an exchange-traded fund like the iShares Silver Trust (SLV:NYSE), look to the price spike in late April to find your resistance point. For investors looking at silver mining companies, be aware that mining costs, like fuel prices, impact profits. Keep an eye on operating margins as companies report earnings. Lower margins could mean lower earnings moving forward. Publisher's Note: Taipan's Michael Robinson is the best in the business when it comes to playing the silver market. So far this year, he has led American Wealth Underground subscribers to gains of 200%, 68%, 140% and 353%... all thanks to silver and the metals market. Michael recently unveiled his latest special report. There is a strong chance it will lead to his biggest gains yet. To learn what our silver expert has uncovered, follow the link.

Article brought to you by Taipan Publishing Group. Additional valuable content can be syndicated via our News RSS feed. Republish without charge. Required: Author attribution, links back to original content or www.taipanpublishinggroup.com.

Source: http://countingpips.com

Tuesday, July 19, 2011

Gold Jumps Above 1,600-Dollar Mark On U.S., European Debt Concerns

CHICAGO, July 18 (Xinhua) -- Gold futures on the COMEX Division of the New York Mercantile Exchange extended its winning streak into a 10th session on Monday, settling above 1,600 dollars per ounce, as concerns about the eurozone debt crisis and the lack of agreement on raising the U.S. debt ceiling prompted investors to flock to the precious metal as a safe haven.

The most active gold contract for August delivery rallied 12.3 dollars, or 0.8 percent, to 1,602.4 dollars per ounce.

Analysts mentioned that there are growing concerns among investors that Europe's debt crisis will spread to Italy and Spain, ahead of an emergency meeting of EU leaders later this week, amid continuing uncertainty over the ability of European officials to agree on a second aid program for Greece and stop Greece's trouble from spreading to other debt-plagued eurozone nations.

A trader mentioned that investors are also worried by the inability of U.S. politicians to work out a deal before Aug. 2, the deadline for Congress to pass legislation to raise the debt ceiling and effectively prevent a default.

Silver for September delivery surged 1.271 dollars, or 3.3 percent, to 40.342 dollars per ounce.

Source: http://news.xinhuanet.com

The most active gold contract for August delivery rallied 12.3 dollars, or 0.8 percent, to 1,602.4 dollars per ounce.

Analysts mentioned that there are growing concerns among investors that Europe's debt crisis will spread to Italy and Spain, ahead of an emergency meeting of EU leaders later this week, amid continuing uncertainty over the ability of European officials to agree on a second aid program for Greece and stop Greece's trouble from spreading to other debt-plagued eurozone nations.

A trader mentioned that investors are also worried by the inability of U.S. politicians to work out a deal before Aug. 2, the deadline for Congress to pass legislation to raise the debt ceiling and effectively prevent a default.

Silver for September delivery surged 1.271 dollars, or 3.3 percent, to 40.342 dollars per ounce.

Source: http://news.xinhuanet.com

Wednesday, July 13, 2011

Gold Prices Rise Highest Since 2009

The price of gold recorded the largest increase since November 2009. This safe-haven commodity prices could rise to 3.9 percent scored at the weekend. Gold prices are skyrocketing because of poor employment data in the United States. As a result, market participants expectations the country’s slowing economy would seem to prove.

In early trading today, gold prices rose to USD1.544, 14 per ounce. This is the highest level in two weeks. As quoted by Reuters on Monday (7/11/2011), the gold price this morning was observed stagnant amid poor sentiment coming from the U.S. economy and fears of debt crisis of the Euro Zone. Gold prices fell 0.1 percent to USD1.542 per ounce. U.S. gold GCcv1 gold was little changed at USD1.542, 80.

President Barack Obama met with leaders from both parties, trying to break the deadlock with a Republican plan related to deficit reduction and to avoid debt default.

European Council President Herman Van Rompuy said it had an emergency meeting with officials related to the debt crisis of the Euro Zone on Monday morning. The trigger is a crisis fears spread to Italy, the third largest country in the region.

Read more:http://cnbusinessnews.com

In early trading today, gold prices rose to USD1.544, 14 per ounce. This is the highest level in two weeks. As quoted by Reuters on Monday (7/11/2011), the gold price this morning was observed stagnant amid poor sentiment coming from the U.S. economy and fears of debt crisis of the Euro Zone. Gold prices fell 0.1 percent to USD1.542 per ounce. U.S. gold GCcv1 gold was little changed at USD1.542, 80.

President Barack Obama met with leaders from both parties, trying to break the deadlock with a Republican plan related to deficit reduction and to avoid debt default.

European Council President Herman Van Rompuy said it had an emergency meeting with officials related to the debt crisis of the Euro Zone on Monday morning. The trigger is a crisis fears spread to Italy, the third largest country in the region.

Read more:http://cnbusinessnews.com

Friday, July 8, 2011

Family fights government over rare ‘Double Eagle’ gold coins

A jeweler's heirs are fighting the United States government for the right to keep a batch of rare and valuable "Double Eagle" $20 coins that date back to the Franklin Roosevelt administration. It's just the latest coin controversy to make headlines.

Philadelphian Joan Langbord and her sons say they found the 10 coins in 2003 in a bank deposit box kept by Langbord's father, Israel Switt, a jeweler who died in 1990. But when they tried to have the haul authenticated by the U.S. Treasury, the feds, um, flipped.

They said the coins were stolen from the U.S. Mint back in 1933, and are the government's property. The Treasury Department seized the coins, and locked them away at Fort Knox. The court battle is set to kick off this week.

The rare coins (pictured), first struck in 1850, show a flying eagle on one side and a figure representing liberty on the other. One such coin recently sold at auction for $7.6 million, meaning the Langbords' trove could be worth as much as $80 million.

The coins are part of a batch that were struck but then melted down after President Roosevelt took the country off the gold standard in 1933, during the Great Depression. Two were given to the Smithsonian Institution*, but a few more mysteriously escaped.

The government has long believed that Switt schemed with a corrupt cashier at the Mint to swipe the coins. They note that the deposit box in which the coins were found was rented six years after Switt's death, and that the family never paid inheritance tax on the coins.

A lawyer for the Langbords counters that the coins could have left the Mint legally since it was permissible to swap gold coins for gold bullion.

Authorities in the Roosevelt era twice looked into Switt's coin dealings, including his possession of Double Eagle coins. In 1944, Switt's license to deal scrap gold was revoked.

The battle over the Double Eagles is hardly the only recent coin contretemps. Two British metal-detecting enthusiasts are said to be locked in a bitter dispute over how to divide the profits from a horde of Iron Age gold coins that they unearthed together in eastern England in 2008.

And an 80-year-old California man was jailed in 2009 after allegedly hitting another man in the head with a metal pipe and firing a gun at a third man during a dispute over missing gold coins.

Some coin disputes involve more than wrangling over valuable collectors' items. In 2007, Secret Service and FBI agents raided an Indiana company called Liberty Dollar, in a bid to stamp out illegal currency. The firm was making "Ron Paul Silver Dollars," in honor of Rep. Ron Paul, whose presidential campaign advocates bringing back the gold standard.

And since we're talking about coins, here's a list of the ten most valuable coins you might find in your pocket change.

* This sentence previously referred incorrectly to the "Smithsonian Institute."

Source: www.yahoo.com

Philadelphian Joan Langbord and her sons say they found the 10 coins in 2003 in a bank deposit box kept by Langbord's father, Israel Switt, a jeweler who died in 1990. But when they tried to have the haul authenticated by the U.S. Treasury, the feds, um, flipped.

They said the coins were stolen from the U.S. Mint back in 1933, and are the government's property. The Treasury Department seized the coins, and locked them away at Fort Knox. The court battle is set to kick off this week.

The rare coins (pictured), first struck in 1850, show a flying eagle on one side and a figure representing liberty on the other. One such coin recently sold at auction for $7.6 million, meaning the Langbords' trove could be worth as much as $80 million.

The coins are part of a batch that were struck but then melted down after President Roosevelt took the country off the gold standard in 1933, during the Great Depression. Two were given to the Smithsonian Institution*, but a few more mysteriously escaped.

The government has long believed that Switt schemed with a corrupt cashier at the Mint to swipe the coins. They note that the deposit box in which the coins were found was rented six years after Switt's death, and that the family never paid inheritance tax on the coins.

A lawyer for the Langbords counters that the coins could have left the Mint legally since it was permissible to swap gold coins for gold bullion.

Authorities in the Roosevelt era twice looked into Switt's coin dealings, including his possession of Double Eagle coins. In 1944, Switt's license to deal scrap gold was revoked.

The battle over the Double Eagles is hardly the only recent coin contretemps. Two British metal-detecting enthusiasts are said to be locked in a bitter dispute over how to divide the profits from a horde of Iron Age gold coins that they unearthed together in eastern England in 2008.

And an 80-year-old California man was jailed in 2009 after allegedly hitting another man in the head with a metal pipe and firing a gun at a third man during a dispute over missing gold coins.

Some coin disputes involve more than wrangling over valuable collectors' items. In 2007, Secret Service and FBI agents raided an Indiana company called Liberty Dollar, in a bid to stamp out illegal currency. The firm was making "Ron Paul Silver Dollars," in honor of Rep. Ron Paul, whose presidential campaign advocates bringing back the gold standard.

And since we're talking about coins, here's a list of the ten most valuable coins you might find in your pocket change.

* This sentence previously referred incorrectly to the "Smithsonian Institute."

Source: www.yahoo.com

Wednesday, July 6, 2011

Silver Prices & Gold Prices Unsurprisingly Will Definitely Unquestionably Climb To New Highs!

PRLog (Press Release) – Jul 04, 2011– At the time of this composing, Gold rose in spot trading by $7.30, or 0.49 %, to $1,494.80 an ounce, bringing the loss this last thirty days to 3.18 %, while silver jumped 0.71 % to $34.19 an ounce. In the mean time, gold bar and coin need within the Middle East jumped 39 percent within the fourth quarter from the year previously, based on World Gold Council figures. Visit http://silver-

Collectively with gold, silver prices are in the mercy of investment option demand, safe-haven purchasing, inflation fears, momentum purchasing and selling and cost manipulation. The one facet that silver prices have going for them that gold does not are an enormous amount of industrial need.

Certainly, silver may be discovered within a selection of products, from iPads to autos to photovoltaic panels, which tends to create it the ideal metal for all these looking for a hedge in opposition to currency debasement as well as publicity to some worldwide monetary recovery.

David Morgan, the founder of Silver-Investor.com, states he could see silver prices as significant as $45 in 2011 "and if things get really crazy we could go beyond that." Visit http://www.silver-

Silver is likewise in the mercy of stocks and bonds. Whenever equities plummet, investors are frequently pressured to market silver for cash, but any substantial dip can set off a wave of purchasing as investors buy silver at a lot less costly prices, resulting within a powerful tug of war. Simply because less individuals own silver than gold, the marketplace is smaller sized, which results in violent price actions.

Turmoil is nonetheless evident in the Middle East nations. Bahrain’s police forces attacked demonstrators for another day. Gunfire started in Yemen’s capital as pro-democracy protests pass on to Libya and Iran.

“If you see violence, you would buy precious metals for a safe haven,” states Peter Fertig, the operator of Quantitative Commodity Research Ltd. in Hainburg, Germany. Visit http://silver-

Gold would appear to have room for a lot more gains no matter further Chinese monetary tightening, states HSBC. The gold metal at first dipped Friday subsequent China announcing a 50-basis-point hike in the reserve ratio for banking establishments, the eighth hike of the stage. “The ability of gold to bounce back after the sell-off in the aftermath of the China rate announcement is impressive, in our view,” HSBC states. “It displays underlying strong demand that is not necessarily dependent on China.” HSBC’s economics adviser on China looks to get at least an extra one hundred basis points in reserve-ratio hikes via the People’s Bank of China all through the next 6 months. “The gold market is unlikely to cool significantly in response to further Chinese tightening until that tightening is seen to be effective, we believe," HSBC says. "This leaves further room to the upside, as Chinese bullion demand remains strong.”

Expanding food and commodity prices have contributed to uprisings within the Middle East. “There are still flare-ups and people getting hurt,” stated Adam Klopfenstein, a senior marketplace strategist at Lind-Waldock in Chicago. “There’s more talk of inflation, and no one wants to be short of precious metals heading into the weekend.” Time for you to buy gold and silver is now!

Collectively with gold, silver prices are in the mercy of investment option demand, safe-haven purchasing, inflation fears, momentum purchasing and selling and cost manipulation. The one facet that silver prices have going for them that gold does not are an enormous amount of industrial need.

Certainly, silver may be discovered within a selection of products, from iPads to autos to photovoltaic panels, which tends to create it the ideal metal for all these looking for a hedge in opposition to currency debasement as well as publicity to some worldwide monetary recovery.

David Morgan, the founder of Silver-Investor.com, states he could see silver prices as significant as $45 in 2011 "and if things get really crazy we could go beyond that." Visit http://www.silver-

Silver is likewise in the mercy of stocks and bonds. Whenever equities plummet, investors are frequently pressured to market silver for cash, but any substantial dip can set off a wave of purchasing as investors buy silver at a lot less costly prices, resulting within a powerful tug of war. Simply because less individuals own silver than gold, the marketplace is smaller sized, which results in violent price actions.

Turmoil is nonetheless evident in the Middle East nations. Bahrain’s police forces attacked demonstrators for another day. Gunfire started in Yemen’s capital as pro-democracy protests pass on to Libya and Iran.

“If you see violence, you would buy precious metals for a safe haven,” states Peter Fertig, the operator of Quantitative Commodity Research Ltd. in Hainburg, Germany. Visit http://silver-

Gold would appear to have room for a lot more gains no matter further Chinese monetary tightening, states HSBC. The gold metal at first dipped Friday subsequent China announcing a 50-basis-point hike in the reserve ratio for banking establishments, the eighth hike of the stage. “The ability of gold to bounce back after the sell-off in the aftermath of the China rate announcement is impressive, in our view,” HSBC states. “It displays underlying strong demand that is not necessarily dependent on China.” HSBC’s economics adviser on China looks to get at least an extra one hundred basis points in reserve-ratio hikes via the People’s Bank of China all through the next 6 months. “The gold market is unlikely to cool significantly in response to further Chinese tightening until that tightening is seen to be effective, we believe," HSBC says. "This leaves further room to the upside, as Chinese bullion demand remains strong.”

Expanding food and commodity prices have contributed to uprisings within the Middle East. “There are still flare-ups and people getting hurt,” stated Adam Klopfenstein, a senior marketplace strategist at Lind-Waldock in Chicago. “There’s more talk of inflation, and no one wants to be short of precious metals heading into the weekend.” Time for you to buy gold and silver is now!

Silver Dollar Values is the premier coin price guide website for information on old coin values and silver dollar values, as well as gold prices, silver prices, silver bullion, gold bullion, gold coins and much more.

Source: http://www.prlog.org

Sunday, July 3, 2011

Double Dip Recession At Hand

Here we are, in the middle of 2011. Many interventions have come and gone and yet, as each stimulus has faded out in hopes of a strong economic recovery, unemployment and housing keeps falling. Yes, there has been some job creation — but at a pace barely keeping up with population growth. The percentage of American adults with jobs, which plunged between 2007 and 2009, has barely budged since then. The latest numbers suggest that even this modest, inadequate job growth is sputtering out. And as far as the housing market goes, that just keeps hovering amidst a cloud of gloom. So far, most Washington politicos and Wall Street bankers are in denial, refusing to see the worsening signs of renewed recession. Instead, they are arguing for restrictive economic policies that, if enacted, would exacerbate the developing downturn, that history books would liken to the policy mistakes of the 1930. — An already repeated version of the mistake of 1937, withdrawing fiscal support much too early and perpetuating high unemployment.

The economy is almost at a stalling speed which is supposed to be roaring out of recovery. The yield curve is full of hiccups and steeply sloping down. On the fiscal side, Republicans are demanding immediate spending cuts as the price of raising the debt limit and avoiding US default. If this succeeds, it will put a further drag on already weak economy.

All eyes and ears in the gold and world financial markets will be focused later this week on the June FOMC meeting and Chairman Bernanke’s press conference for the Fed’s assessment of the economy, inflation and employment prospects, and any hints of forthcoming adjustments to Fed policy. Republicans and Democrats will go head to head to solve the problem.

In essence, the problem is not on the supply side of the ledger, but on the demand side. American consumers, who constitute 70% of the total economy, cannot and will not buy enough to get it moving. They’re either out of a job, don’t have the money to spend, or justifiably worry that they will not be able to pay their bills and afford to send their children to college, or to retire.

If the Fed, indeed, ends its program of quantitative easing at month-end as scheduled, it will soon be forced by rising unemployment and sluggish business activity to resume monetary stimulus in one form or another. Perhaps not QE3 – a further round of quantitative easing might be difficult to swallow – but a rose of some other name.

In the meanwhile, as the incoming economic indicators are pointing to a second phase in what is quickly becoming a double-dip recession, clearly, gold-price direction and volatility will be affected in the weeks and months ahead by the economic developments discussed in the U.S.

Moreover, there is potential for events across North Africa and the Middle East to trigger a rush into gold . Instability spread to Iran and/or Saudi Arabia; should Afghanistan or Iraq deteriorate into all-out civil war; should democratic reform in Egypt or Tunisia be replaced with new tyrants less friendly to the West; should regime change in Libya, Syria, or Yemen herald in worse; or should oil supplies and prices become less secure. “There are many issues that are pushing forward for precious metals, one thing is certain this will be a golden summer” says President Ron Fricke of Regal Assets.

Whatever the immediate future holds in store, we remain firmly committed to our bullish gold -price forecast with the metal trading at or close to $1700 later this year with still higher prices in the years ahead.

Source: http://goldcoinblogger.com

Four Fundamental Reasons to Buy Gold and Silver

THE REASONS to Buy Gold and silver – and by that I mean physical gold and silver – are pretty straightforward, writes Chris Martenson.

So let's begin with the primary reasons to Buy Gold.

- To protect against monetary recklessness

- As insulation against fiscal foolishness

- As insurance against the possibility of a major calamity in the banking/financial system

- For the embedded 'option value' that will pay out if and when gold is remonetized

By 'monetary recklessness,' I mean the creation of money out of thin air and the application of more liquidity than the productive economy actually needs. The central banks of the world have been doing this for decades, not just since the onset of the great financial crisis.

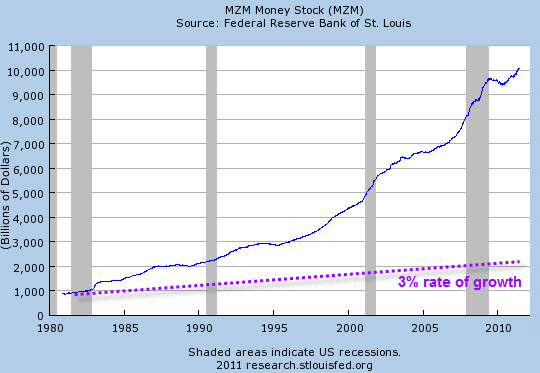

In gold terms, the supply of above-ground gold is growing at roughly 3% per year, while money supply has been growing at nearly three times that yearly rate since 1980.

Now this is admittedly an unfair view, because the economy has been growing, too. But money and credit growth have handily outpaced even the upwardly distorted GDP measurements by a wide margin.

As the economy stagnates under this too-large debt load while the credit system continues to operate as if perpetual expansion were possible, look for all the resulting extra dollars to show up in prices of goods and services.

Real interest rates are deeply negative (meaning that the rate of inflation is higher than Treasury bond yields). This is a forced, manipulated outcome courtesy of central banks that are buying bonds with thin-air money. Historically, periods of negative real interest rates are nearly always associated with outsized returns for commodities, especially precious metals. If and when real interest rates turn positive, I will reconsider my holdings in gold and silver, but not until then.

That is as close to an absolute requirement as I have in this business.

Monetary policies across the developed world remain as accommodating as they've ever been. Even Greenspan's 1% blow-out special in 2003 was not as steeply negative in real terms as what Bernanke has recently engineered. But it is the highly aggressive and 'alternative' use of the Federal Reserve balance sheet to prop up insolvent banks and to sop up extra Treasury debt that really has me worried.

There seems to be no way to end these ever-expanding programs, and they seem to have become a permanent feature of the economic and financial landscape. In Europe, the equivalent would be the sovereign debt now found on the European Central Bank (ECB) balance sheet.

Federal deficits are seemingly out of control and are now stuck in the -$1.5 trillion range. Massive deficit spending has always been inflationary, and inflation is usually gold/silver friendly. Although not always, mind you, as the correlation is not strong, especially during mild inflation (less than 5%).

Note, for example, that gold fell from its high in 1980 all the way to its low in 1998, an 18 year period with plenty of mild inflation along the way. Sooner or later, though, I expect extraordinary budget deficits to translate into extraordinary inflation.

Reason #3, insurance against a major calamity in the banking system, is an important part of my rationale for holding gold. I'm not referring to "paper gold" either, which includes the various tradable vehicles (like the "GLD" ETF) that you can buy like stocks through your broker.

I'm talking about physical gold and silver because of their unusual ability to sit outside of the banking/monetary system and act as monetary assets.

All other financial assets – including your paper US money – is simultaneously somebody else's liability, but gold and silver are not. They are simply, boringly, just assets. This is a highly desirable characteristic that is not easily replicated.

Should the banking system suffer a systemic breakdown, to which I ascribe a reasonably high probability of greater than 1-in-4 over the next 5 years, I expect banks to close for some period of time. Whether it's two weeks or six months is unimportant; no matter the length of time, I'd prefer to be holding gold than bank deposits.

During a banking holiday, your money will be frozen and left just sitting there, even as everything priced in money (especially imported items) rocket up in price. By the time your money is again available to you, you may find that a large portion of it has been looted by the effects of a collapsing currency.

How do you avoid this? Easy; keep some 'money' out of the system to spend during an emergency. I always advocate three months of living expenses in cash, but you owe it to yourself to have gold and silver in your possession as well.

The final reason for holding gold, because it may be remonetized, is actually a very big draw for me. While the probability of this coming to pass may be low, the rewards would be very high.

Here are some numbers: The total amount of 'official gold,' or that held by central banks around the world, is 30,684 tonnes, or 987 million troy ounces. In 2008 the total amount of money stock in the world was roughly $60 trillion.

If the world wanted 100% gold backing of all existing money, then the implied price for an ounce of gold is $60 trillion divided by 987 million ounces – $60,790 per troy ounce.

Clearly that's a silly number (or is it?), but even a 10% partial backing of money yields $6,000 per ounce. The point here is not to bandy about outlandish numbers, but merely to point out that unless a great deal of the world's money stock is destroyed somehow, or a lot more official gold is bought from the market and placed into official hands, backing even a fraction of the world's money supply by gold will result in a far higher number than today's $1500 per ounce.

Source: http://goldnews.bullionvault.com

Subscribe to:

Posts (Atom)