Reuters) - Gold rose 1 percent to a four-month high above $1,670 an ounce on Thursday, bolstered by hopes for a new round of U.S. monetary stimulus and news that Spain is negotiating conditions for a possible aid package.

Silver surged 2 percent and platinum group metals also climbed on supply concerns due to labor unrest in South Africa.

Precious metals received a boost after sources told Reuters Spain is in talks with the euro zone over conditions for international aid, even though the country has made no final decision to request a bailout.

Bullion consolidated its breakout above a four-month trading range and technical resistance at the 150-day and 200-day moving averages. However, gold's relative strength index suggests the market might be slightly overbought following its seventh consecutive day of gains. (r.reuters.com/xub32t)

The move higher came amid already-bullish market sentiment, with Wednesday's minutes from the U.S. Federal Reserve's August meeting showing policymakers were ready to deliver more stimulus "fairly soon" unless the economy improves considerably.

"This is the first insight we've gotten in the marketplace to think that the Fed is committed to this new stimulus program, and that's the catalyst you need to break out of the range," said Jeffrey Sherman, commodities portfolio manager at DoubleLine Capital LP, which has over $40 billion in assets under management.

Spot gold gained 0.9 percent to $1,668.70 an ounce by 2:25 p.m. EDT (1825 GMT), having risen 3.5 percent so far this week.

That put gold on track to post its largest monthly rise since January's 11 percent increase.

U.S. gold futures for December delivery settled up $32.30 at $1,672.80 an ounce. Trading volume looked set to challenge its highest in almost a month, preliminary Reuters data showed.

Silver rose 2.2 percent to $30.49 an ounce.

Bullion broke ranks with U.S. equities, which fell after the number of Americans filing new claims for jobless benefits unexpectedly increased, and after St. Louis Federal Reserve President James Bullard played down the odds of imminent easing.

WEAKNESS SEEN IF FED DISAPPOINTS

Bullion is now up nearly 7 percent year to date, still below the 15 percent in January when the Fed signaled it might use more stimulus and would keep interest rates near zero until at least 2014.

"Market expectations on monetary easing might be too high and that could lead to pullbacks," said Nicolas Berge, a trader at Geneva-based hedge fund Absolute Capital Group which invests in commodities futures and currencies.

Gold's breakout above its downward trend confirms the potential start of a longer-term bull market, Berge said.

Bullion held in top exchange-traded funds monitored by Reuters hit a record by Wednesday's close, having risen by more than 600,000 ounces this week so far, marking the largest weekly rise since early February.

Gold investors also monitored news that Citi Private Bank deciding it will withdraw up to $500 million from long-time gold bull and prominent hedge fund manager John Paulson's flagship Advantage funds, which held some gold investments.

In platinum group metals (PGM), ETF Securities said that its U.S. PGM exchange-traded products added nearly $50 million in new assets in the last week due to supply worries following deadly violence and work stoppage in South African mines.

Platinum rose 0.4 percent to $1,536.75 an ounce and palladium was up 3.5 percent at $650.75 an ounce.

Source: http://www.reuters.com

Showing posts with label News. Show all posts

Showing posts with label News. Show all posts

Monday, September 3, 2012

Monday, August 27, 2012

Silver to hit $50 by end of 2012

NEW YORK (Commodity Online): Silver prices likely to reach $50 an ounce and gold prices to bounce back to $1900 levels, said Stephen Smith, managing member of Smith McKenna, LLC.

According to Smith, the precious metal boom that was cut short in 2011 could be making a strong comeback in late 2012 and over the next few years.

The metal to keep a watchful eye on is silver. Analysts and precious metal experts are in harmony on predictions of silver surpassing $50/oz. and gold edging above $1,900/oz by as early as year end.

Investing in silver ahead of the future outlook for both the global economy and manufacturing sector could prove to be very rewarding. 2011 marked the end to a bullish few years which made a lot of people very wealthy.

While gold is still expensive, silver is the commodity that investors should be paying special attention to. Silver in relation to gold is priced substantially lower; it's undervalued and is expected to respond bullishly over the next few years.

Those who don't currently invest in silver should at least be gathering all the information they can. Current precious metal investors have already shifted their support and focus on the white metal amid global cues and its exceptional properties with continuing limited supply. In short, precious metals should be a part of everyone's investment portfolio; it's all about diversification.

"Most people miss out on precious metal market booms and investing in silver because of uncertainty and lack of information. Potential wealth creation is all about the long term outlook with the right position and knowledge," Stephen Smith added.

Silver has both usage as an industrial metal and value as a precious commodity; making it sensitive to the economic outlook and global manufacturing. Silver has large ties and demand in the pharma industry, solar panel production and electronics.Limited bullion supply, increased demand and global easing could send the price of silver into the clouds.

As a society we're just not as educated on precious metals as an investment source. The banking industry and Wall Street want to remain in the spotlight, but they often have their own hidden agendas. According to Smith, "Silver could perform stronger and be a better investment vehicle than your IRA/401k."

Tuesday's Q2 2012 Euro GDP report showed expected economist predictions with little impact on the silver market.Analysts are still expecting further easing amid high interest rates, debt crises, budget cuts, and limited spending. Money printing and easing could once again send precious silver and gold on a wild ride to new highs.

Silver was seen around $28/oz last week with analysts holding to their notions of silver sitting on the cusp of a strong rebound.There's a reason why investors are currently shifting their focus and doing their homework on precious silver. Its value ratio to gold is heavily skewed and stimulus efforts and economic rebounding could prove to be the recipe that silver has been patiently waiting for.

Silver is a historical form of currency and store of value. Precious metals are a physical asset meaning they are not manufactured but rather limited in supply, making their value exceptionally strong. Owning physical silver is one of the keys to investing in the white metal, staying away from ETFs, Futures and Options.

Source: http://www.commodityonline.com

According to Smith, the precious metal boom that was cut short in 2011 could be making a strong comeback in late 2012 and over the next few years.

The metal to keep a watchful eye on is silver. Analysts and precious metal experts are in harmony on predictions of silver surpassing $50/oz. and gold edging above $1,900/oz by as early as year end.

Investing in silver ahead of the future outlook for both the global economy and manufacturing sector could prove to be very rewarding. 2011 marked the end to a bullish few years which made a lot of people very wealthy.

While gold is still expensive, silver is the commodity that investors should be paying special attention to. Silver in relation to gold is priced substantially lower; it's undervalued and is expected to respond bullishly over the next few years.

Those who don't currently invest in silver should at least be gathering all the information they can. Current precious metal investors have already shifted their support and focus on the white metal amid global cues and its exceptional properties with continuing limited supply. In short, precious metals should be a part of everyone's investment portfolio; it's all about diversification.

"Most people miss out on precious metal market booms and investing in silver because of uncertainty and lack of information. Potential wealth creation is all about the long term outlook with the right position and knowledge," Stephen Smith added.

Silver has both usage as an industrial metal and value as a precious commodity; making it sensitive to the economic outlook and global manufacturing. Silver has large ties and demand in the pharma industry, solar panel production and electronics.Limited bullion supply, increased demand and global easing could send the price of silver into the clouds.

As a society we're just not as educated on precious metals as an investment source. The banking industry and Wall Street want to remain in the spotlight, but they often have their own hidden agendas. According to Smith, "Silver could perform stronger and be a better investment vehicle than your IRA/401k."

Tuesday's Q2 2012 Euro GDP report showed expected economist predictions with little impact on the silver market.Analysts are still expecting further easing amid high interest rates, debt crises, budget cuts, and limited spending. Money printing and easing could once again send precious silver and gold on a wild ride to new highs.

Silver was seen around $28/oz last week with analysts holding to their notions of silver sitting on the cusp of a strong rebound.There's a reason why investors are currently shifting their focus and doing their homework on precious silver. Its value ratio to gold is heavily skewed and stimulus efforts and economic rebounding could prove to be the recipe that silver has been patiently waiting for.

Silver is a historical form of currency and store of value. Precious metals are a physical asset meaning they are not manufactured but rather limited in supply, making their value exceptionally strong. Owning physical silver is one of the keys to investing in the white metal, staying away from ETFs, Futures and Options.

Source: http://www.commodityonline.com

Thursday, August 2, 2012

Silver Price Psychology

People have a natural tendency to seek and understand value. The currently dominant baby boomer generation has a speculative mindset with regard to investment. The relatively frugal generation that lived through the first great depression is now fading in influence, along with their collective memory of harder times.

Both professional and individual traders tend to chase momentum, with pros often using technical analysis to justify market movements and their positioning in the market. Individual investors also listen to professionals talking their book, rather than to more objective experts.

Silver Prices Spikes

Nevertheless, in the silver market, any significant spike higher tends to feed on itself. This is not only due to speculative buying momentum, but also due to short covering buying as the truly limited supply of physical silver exerts its upward influence on the metal’s price.

While inevitable does not imply imminent, the longer the current price suppression paradigm lasts in the silver market, the tighter the spring becomes coiled, and the higher will be the price’s ultimate release upward.

Understanding Silver’s Value

The main point here is that silver’s intrinsic value is currently understood and accepted by only the few who got into the market early. Those who get into it once the inevitable rally has started will be buying on impulse or out of fear, only rationalizing their investment after the fact.

Some might believe that silver’s price spiking higher will suddenly and magically bring out all of the physical silver ever mined throughout history, including the billions of ounces currently sequestered in technological components, silverware and jewelry.

While some recovery of metallic silver from these recycling sources is likely, the most probable outcome will be an increasing scarcity of physical silver that will fail to meet the growing demand.

Although the masses might be manipulated into seeing spiking silver prices as a selling opportunity before the ‘inevitable’ crash — perhaps because 16 ounces of silver historically could buy one ounce of gold — the likelihood remains that silver’s price will ultimately rise both in U.S. dollar terms and relative to the price of gold.

For more articles like this, and to stay updated on the most important economic, financial, political and market events related to silver and precious metals visit http://www.silver-coin-investor.com

source: silverseek.com

Wednesday, July 18, 2012

Gold Prices To Be Higher Next Year, U.S. Dollar Dramatically

Gold prices should be higher next year, but corn and the U.S. dollar should see dramatic gains, said an influential newsletter editor.

Dennis Gartman, editor of the newsletter, The Gartman Letter, said he’s most bullish on corn and the “English-speaking” currencies, including the U.S. dollar, but also the Canadian, Australian and New Zealand dollar, plus the British pound.

Gartman wouldn’t give a specific forecast for gold, only to say that he expected prices to be higher than they currently are a year from now, but not “demonstratively so.”

“I really don’t like to put numbers on things. If you say gold is going to $2,100 and it goes to $2,085, I’m telling you, you taken to the rack because you missed it. The best that you can do in this business is to get the direction right…. If you get the direction right 45% of the time you’re going to beat everybody else,” he said.

Gartman spoke to Kitco News Thursday on the sidelines of the Executives’ Club of Chicago’s Annual Economic Outlook.

He said gold is still in a bull market, but right now he is holding a neutral stance. “There are only three positions you can take in a bull market: really long, long and neutral. Right now I think neutral is the place to be,” he said.

Gartman is famous for trading gold in currencies other than the dollar, which gold is denominated in. He frequently trades gold in euro and yen terms. To do so he has said that buys gold and simultaneously sells the other currency, trying best to match equal dollar sums on both sides of the trade.

“Too many people have thought of gold as being an anti-dollar trade. If it is, by buying it in euro terms, I’ve effectively hedged out the dollar risk. Quite honestly under most circumstances – not all – but on days that gold would get whacked, then the euro would get whacked. That has allowed me to breathe on down days in gold,” he said.

He told the audience at the Executive’s Club outlook panel that other markets he’s bullish on are corn, coal – both thermal and metallurgical – and dollars, whether U.S., Canadian, Australian and New Zealand, but did not elaborate.

He added that the U.S. dollar will be “dramatically higher” by next year and said it will remain as the world’s reserve currency, saying it’s “idiocy” not to think so. He said the U.S. military superiority guarantees that dominance. “No one else comes close to the U.S. defense capability,” he said.

He’s also very bullish stock markets, both U.S. and other stock markets, saying that the amount of fiscal stimulus via quantitative easing by the Federal Reserve and ultra-low interest rates in many other countries will benefit equities. When the moderator of the panel asked what his forecast for the Dow Jones Industrial Average would be in a year’s time, he said 16,500. It is now around 12,350.

He also told the Executive’s Club audience that he has no love for “gold bugs,” saying that they remind him of Ted Kaczynski, a recluse survivalist who was known as the “Unabomber” for his letter bombs than spanned 20 years. Gold bugs, he said, have their gold holdings, “dried food, water and live up in caves.”

Gold is “nothing more than another currency. It’s the second reserve currency,” he told the audience.

He’s bearish on the euro overall, but given the rise Friday in the single currency, he said in his newsletter Friday he is standing aside for now.

In the Kitco News interview he said with West Texas Intermediate crude oil at $105 a barrel, the type of oil traded at the New York Mercantile Exchange, that it brings an “awful lot” of new drilling, but he is not “overtly bullish” on energy.

Gartman wouldn’t say if he was shorting any particular trade or market, but he said he would avoid European stocks on the balance, and would prefer to own U.S., Canadian or Australian equities.

CONSIDERS HIMSELF A TECHNICAL TRADER

Regarding his trading technique, he told Kitco News that he considers himself to be 55% a technical trader and 45% a fundamentalist. “The first thing I do is look at a chart. I want to buy things that are going up. I spend weekends leafing through charts to find things that are interesting,” he said. “Do I approach things from a fundamental view first? No, not really. I find that to be a great waste of time. I’ll find out the fundamentals later. If I find a chart that looks bullish, I’ll go find out the fundamentals of whatever it is and if I can understand the bullish fundamentals, if they make sense to me, then I’ll trade.”

He said he trades “a lot” of stocks, but he doesn’t talk about it because of regulatory limitations.

He recommended to those who are new to the market to understand technical analysis before they get started. “I don’t think you can be a ‘trader/investor’ without having some cursory knowledge of technical matters. I do find that people who get esoteric about … chats … I find those people really don’t really very well. Keep it simple,” he said.

He said his job is to be the “liberal arts major of the capital markets,” saying that he knows a little bit about the different markets.

“Grain guys don’t know anything about foreign exchange. Foreign exchange guys don’t know anything about oil. Oil guys don’t know anything about grains. My job is to, one, trade them all and two, be the liberal arts major of the capital markets. Do I know more about the grains than a grain guy does? Oh, God, no. But I know more than a bond guy does,” he said.

Source:http://www.forbes.com

Dennis Gartman, editor of the newsletter, The Gartman Letter, said he’s most bullish on corn and the “English-speaking” currencies, including the U.S. dollar, but also the Canadian, Australian and New Zealand dollar, plus the British pound.

Gartman wouldn’t give a specific forecast for gold, only to say that he expected prices to be higher than they currently are a year from now, but not “demonstratively so.”

“I really don’t like to put numbers on things. If you say gold is going to $2,100 and it goes to $2,085, I’m telling you, you taken to the rack because you missed it. The best that you can do in this business is to get the direction right…. If you get the direction right 45% of the time you’re going to beat everybody else,” he said.

Gartman spoke to Kitco News Thursday on the sidelines of the Executives’ Club of Chicago’s Annual Economic Outlook.

He said gold is still in a bull market, but right now he is holding a neutral stance. “There are only three positions you can take in a bull market: really long, long and neutral. Right now I think neutral is the place to be,” he said.

Gartman is famous for trading gold in currencies other than the dollar, which gold is denominated in. He frequently trades gold in euro and yen terms. To do so he has said that buys gold and simultaneously sells the other currency, trying best to match equal dollar sums on both sides of the trade.

“Too many people have thought of gold as being an anti-dollar trade. If it is, by buying it in euro terms, I’ve effectively hedged out the dollar risk. Quite honestly under most circumstances – not all – but on days that gold would get whacked, then the euro would get whacked. That has allowed me to breathe on down days in gold,” he said.

He told the audience at the Executive’s Club outlook panel that other markets he’s bullish on are corn, coal – both thermal and metallurgical – and dollars, whether U.S., Canadian, Australian and New Zealand, but did not elaborate.

He added that the U.S. dollar will be “dramatically higher” by next year and said it will remain as the world’s reserve currency, saying it’s “idiocy” not to think so. He said the U.S. military superiority guarantees that dominance. “No one else comes close to the U.S. defense capability,” he said.

He’s also very bullish stock markets, both U.S. and other stock markets, saying that the amount of fiscal stimulus via quantitative easing by the Federal Reserve and ultra-low interest rates in many other countries will benefit equities. When the moderator of the panel asked what his forecast for the Dow Jones Industrial Average would be in a year’s time, he said 16,500. It is now around 12,350.

He also told the Executive’s Club audience that he has no love for “gold bugs,” saying that they remind him of Ted Kaczynski, a recluse survivalist who was known as the “Unabomber” for his letter bombs than spanned 20 years. Gold bugs, he said, have their gold holdings, “dried food, water and live up in caves.”

Gold is “nothing more than another currency. It’s the second reserve currency,” he told the audience.

He’s bearish on the euro overall, but given the rise Friday in the single currency, he said in his newsletter Friday he is standing aside for now.

In the Kitco News interview he said with West Texas Intermediate crude oil at $105 a barrel, the type of oil traded at the New York Mercantile Exchange, that it brings an “awful lot” of new drilling, but he is not “overtly bullish” on energy.

Gartman wouldn’t say if he was shorting any particular trade or market, but he said he would avoid European stocks on the balance, and would prefer to own U.S., Canadian or Australian equities.

CONSIDERS HIMSELF A TECHNICAL TRADER

Regarding his trading technique, he told Kitco News that he considers himself to be 55% a technical trader and 45% a fundamentalist. “The first thing I do is look at a chart. I want to buy things that are going up. I spend weekends leafing through charts to find things that are interesting,” he said. “Do I approach things from a fundamental view first? No, not really. I find that to be a great waste of time. I’ll find out the fundamentals later. If I find a chart that looks bullish, I’ll go find out the fundamentals of whatever it is and if I can understand the bullish fundamentals, if they make sense to me, then I’ll trade.”

He said he trades “a lot” of stocks, but he doesn’t talk about it because of regulatory limitations.

He recommended to those who are new to the market to understand technical analysis before they get started. “I don’t think you can be a ‘trader/investor’ without having some cursory knowledge of technical matters. I do find that people who get esoteric about … chats … I find those people really don’t really very well. Keep it simple,” he said.

He said his job is to be the “liberal arts major of the capital markets,” saying that he knows a little bit about the different markets.

“Grain guys don’t know anything about foreign exchange. Foreign exchange guys don’t know anything about oil. Oil guys don’t know anything about grains. My job is to, one, trade them all and two, be the liberal arts major of the capital markets. Do I know more about the grains than a grain guy does? Oh, God, no. But I know more than a bond guy does,” he said.

Source:http://www.forbes.com

Wednesday, June 13, 2012

Sudan nets $603m in gold exports to April 1

KHARTOUM (REUTERS) - Sudan has exported about 13.2 tonnes of gold in the year to April 1, netting it about $603 million in a push to build up the minerals industry to make up for lost oil revenues, the mining ministry said on Monday.

Sudan has been struggling with a severe economic crisis since South Sudan seceded a year ago, taking with it about three quarters of the country's oil production, previously Khartoum's main source of exports and state revenues.

Officials have said bolstering agricultural and mining exports can help Sudan compensate for a resulting shortfall of foreign currency, which has fuelled soaring inflation over the past year.

Sudan exported about 33.7 tonnes of gold for about $1.5 billion in 2011, and 30.3 tonnes for about $1 billion in 2010, the ministry said in a presentation delivered to parliament.

While many experts say Sudan has great mining potential, many also say it is hard to verify overall production figures because unofficial or "artisanal" gold seekers so far account for a large part of Sudan's gold industry.

The government was working to control smuggling and "illegitimate" exports to help develop the industry, the ministry presentation said.

Sudan was supposed to continue receiving some oil revenues via fees paid by the landlocked South to export its oil through pipelines running through the north, but the two have failed to agree on fees.

In January, South Sudan shut down its entire output of about 350,000 barrels per day to stop Khartoum from taking some crude to make up for what it said were unpaid fees.

The dispute has helped create a $2.4 billion gap in Sudan's public finances and caused exports to plunge 83 percent, the finance minister said in May.

Source : http://www.mineweb.com

Sudan has been struggling with a severe economic crisis since South Sudan seceded a year ago, taking with it about three quarters of the country's oil production, previously Khartoum's main source of exports and state revenues.

Officials have said bolstering agricultural and mining exports can help Sudan compensate for a resulting shortfall of foreign currency, which has fuelled soaring inflation over the past year.

Sudan exported about 33.7 tonnes of gold for about $1.5 billion in 2011, and 30.3 tonnes for about $1 billion in 2010, the ministry said in a presentation delivered to parliament.

While many experts say Sudan has great mining potential, many also say it is hard to verify overall production figures because unofficial or "artisanal" gold seekers so far account for a large part of Sudan's gold industry.

The government was working to control smuggling and "illegitimate" exports to help develop the industry, the ministry presentation said.

Sudan was supposed to continue receiving some oil revenues via fees paid by the landlocked South to export its oil through pipelines running through the north, but the two have failed to agree on fees.

In January, South Sudan shut down its entire output of about 350,000 barrels per day to stop Khartoum from taking some crude to make up for what it said were unpaid fees.

The dispute has helped create a $2.4 billion gap in Sudan's public finances and caused exports to plunge 83 percent, the finance minister said in May.

Source : http://www.mineweb.com

Monday, June 11, 2012

Is the Table Set for a Mania in Gold and Silver?

By: Jeff Clark

It may feel like I'm out of touch with the precious metals markets to broach the subject of a mania today, but I think the table is being set now for a huge move into gold and silver.

There are, however, very valid reasons to reasonably expect a mania in our sector. For one thing, manias have occurred many times before, but the main issue is that a mania in gold and gold stocks is the likely result of the absolute balloon in government debt, deficit spending, and money printing. Saying all that profligacy will go away without inflationary consequences seems naive or foolish. Inflation may not attract investors to gold and silver as much as force them to it.

Now, one could make the argument that any rush into gold and silver will be muted if no one has any savings, especially given that demographers say a quarter of the developed world will soon be retired. But even if individuals are wiped out, the world's money supply isn't getting any smaller, and all that cash has to go somewhere.

I wanted to look at cash levels among various investor groups to get a feel for what's out there, as well as how money supply compares to our industry. Data from some institutional investors are hard to come by, but below is a sliver of information about available cash levels. I compared the cash and short-term investments of S&P 500 corporations, along with M1, to gold and silver ETFs, coins, and equities. While the picture might be what you'd expect, the contrast is still rather striking.

Naturally, not all this money or even a big chunk of it will be used to buy GLD, Barrick, or American Eagles, but it's clear that if any significant fraction of the cash sloshing around the economy were to be used to buy gold, it would have a major impact on the price of gold - which would trigger the mania I fully expect. Let's take a quick look at what kind of impact our sector could experience if just a small amount of available funds were devoted to various forms of gold and silver.

The entire worldwide value of all gold exchange-traded products (ETPs) currently represents just 2.1% of the cash and short-term investments held by S&P 500 corporations. If 20% of these companies decided to put a mere 5% of their available holdings into these precious metals vehicles, their value would more than double.

If just 1% of the physical currency (M1) floating around the system were used to buy gold Eagles, it would be 13 times more than the entire value of all coins purchased last year.

If corporations chose to invest 1% of their cash in silver ETFs, it would surpass the total current value of all such ETFs.

If corporations moved 5% of their "short-term investments" evenly into gold stocks, the market cap of every gold company would increase by 20%.

If they chose silver stocks, they'd each grow by a factor of six.

Five percent of M1 would increase the market cap of gold producers by 14%. The same fraction would be 3.4 times bigger than the entire current value of all primary silver producers.

This is just S&P 500 corporations - there are many more corporations in the world, as well as pension funds, hedge funds, sovereign wealth funds, mutual funds, private equity funds, private wealth funds, insurance companies, and other ETFs.

It's striking, when you really stop to think about just how big the impact could be if some significant fraction of the larger financial world started chasing the small niche market that is gold. Such cash inflows will send our industry to the moon.

In the meantime, keeping our eye on the big-picture forces that have yet to play out is the plan to follow. Sooner or later, though, I'm convinced the catalysts will kick in that will pull/push/drag/compel/force the mainstream into our sector. I suggest beating them to it.

And when the mania arrives, we'll all wonder why anyone doubted it in the first place.

Source : http://www.marketoracle.co.uk

It may feel like I'm out of touch with the precious metals markets to broach the subject of a mania today, but I think the table is being set now for a huge move into gold and silver.

There are, however, very valid reasons to reasonably expect a mania in our sector. For one thing, manias have occurred many times before, but the main issue is that a mania in gold and gold stocks is the likely result of the absolute balloon in government debt, deficit spending, and money printing. Saying all that profligacy will go away without inflationary consequences seems naive or foolish. Inflation may not attract investors to gold and silver as much as force them to it.

Now, one could make the argument that any rush into gold and silver will be muted if no one has any savings, especially given that demographers say a quarter of the developed world will soon be retired. But even if individuals are wiped out, the world's money supply isn't getting any smaller, and all that cash has to go somewhere.

I wanted to look at cash levels among various investor groups to get a feel for what's out there, as well as how money supply compares to our industry. Data from some institutional investors are hard to come by, but below is a sliver of information about available cash levels. I compared the cash and short-term investments of S&P 500 corporations, along with M1, to gold and silver ETFs, coins, and equities. While the picture might be what you'd expect, the contrast is still rather striking.

Naturally, not all this money or even a big chunk of it will be used to buy GLD, Barrick, or American Eagles, but it's clear that if any significant fraction of the cash sloshing around the economy were to be used to buy gold, it would have a major impact on the price of gold - which would trigger the mania I fully expect. Let's take a quick look at what kind of impact our sector could experience if just a small amount of available funds were devoted to various forms of gold and silver.

The entire worldwide value of all gold exchange-traded products (ETPs) currently represents just 2.1% of the cash and short-term investments held by S&P 500 corporations. If 20% of these companies decided to put a mere 5% of their available holdings into these precious metals vehicles, their value would more than double.

If just 1% of the physical currency (M1) floating around the system were used to buy gold Eagles, it would be 13 times more than the entire value of all coins purchased last year.

If corporations chose to invest 1% of their cash in silver ETFs, it would surpass the total current value of all such ETFs.

If corporations moved 5% of their "short-term investments" evenly into gold stocks, the market cap of every gold company would increase by 20%.

If they chose silver stocks, they'd each grow by a factor of six.

Five percent of M1 would increase the market cap of gold producers by 14%. The same fraction would be 3.4 times bigger than the entire current value of all primary silver producers.

This is just S&P 500 corporations - there are many more corporations in the world, as well as pension funds, hedge funds, sovereign wealth funds, mutual funds, private equity funds, private wealth funds, insurance companies, and other ETFs.

It's striking, when you really stop to think about just how big the impact could be if some significant fraction of the larger financial world started chasing the small niche market that is gold. Such cash inflows will send our industry to the moon.

In the meantime, keeping our eye on the big-picture forces that have yet to play out is the plan to follow. Sooner or later, though, I'm convinced the catalysts will kick in that will pull/push/drag/compel/force the mainstream into our sector. I suggest beating them to it.

And when the mania arrives, we'll all wonder why anyone doubted it in the first place.

Source : http://www.marketoracle.co.uk

Tuesday, March 13, 2012

Gold & Silver Market Morning

After New York closed at $1,711 Asia at week’s beginning at first saw gold move to $1,713, but London took it down to $1,706 as the euro slipped back to just above €1: $1.31. The morning Fix in London set it at $1,705.25 and in the euro at €1,299.931 up €14 higher, while the euro stood at €1: 3118. Ahead of New York’s opening it stood at $1,704.15 and in the euro €1,299.99 while the euro was at €1: $1.3109. Silver slipped back in line with gold to just under $34 in London. Ahead of New York’s opening it stood at $33.92.

Gold(very short-term)

Gold is expected to tighten its consolidation range before a large move, in New York today.

Silver(very short-term)

Silver will tighten its consolidation range before a large move, in New York today.

Price Drivers

At week’s start, the final acceptance of the Greek bailout package is being completed. Private bondholders who refused to accept the offer from Greece will get a 100% payout from their Credit Default Swaps, setting a dangerous precedent for any future situation in another country. For E.U. leaders the key achievement is the prevention of a full blow banking crisis. Few believe that Greece can avoid a full default at some point in the future. But gold and silver investors should not just focus on the Greek situation but on what the European quantitative easing mean for the value of the euro. Well managed currencies have risen in value while the value of both the dollar and the euro have fallen. But the damage done to well managed currencies as they rise in value precipitated the weakening of those currencies, so as to keep international competitiveness. But this has defeated the wisdom of managing an economy in a prudent fashion. This has left currencies an unreliable measure of prices. We see this reflected in part in the price of oil now and in the rising prices of silver and gold. Will this change? No, the priorities of European Union members will swing to promoting growth which implies more currency weakening [alongside the U.S. dollar].

We reiterate what we have pointed out before and that is that there is a reduction in systemic liquidity that demands freshly printed money to fill the gaps left by these deflationary influences. ECB President Mario Draghi gave banks more than €1 trillion ($1.31 trillion) of three-year loans in December and February. Until deflation is turned back to growth, this process will continue. As the oil price rises, so that deflationary influence persists, sucking money out of countries that import oil. The entire process is gold positive. More than that, the process itself throws doubts of the system’s ability to retain value or stability. Gold and silver become retreats from the uncertainty spawned by these dangers. There is no sign of a change in system needed to give currencies dependable values. [To get more of the right perspectives on the gold and silver markets and where gold and silver prices are going, subscribe through www.GoldForecaster.comorwww.SilverForecaster.com].

source: http://news.goldseek.com

Gold(very short-term)

Gold is expected to tighten its consolidation range before a large move, in New York today.

Silver(very short-term)

Silver will tighten its consolidation range before a large move, in New York today.

Price Drivers

At week’s start, the final acceptance of the Greek bailout package is being completed. Private bondholders who refused to accept the offer from Greece will get a 100% payout from their Credit Default Swaps, setting a dangerous precedent for any future situation in another country. For E.U. leaders the key achievement is the prevention of a full blow banking crisis. Few believe that Greece can avoid a full default at some point in the future. But gold and silver investors should not just focus on the Greek situation but on what the European quantitative easing mean for the value of the euro. Well managed currencies have risen in value while the value of both the dollar and the euro have fallen. But the damage done to well managed currencies as they rise in value precipitated the weakening of those currencies, so as to keep international competitiveness. But this has defeated the wisdom of managing an economy in a prudent fashion. This has left currencies an unreliable measure of prices. We see this reflected in part in the price of oil now and in the rising prices of silver and gold. Will this change? No, the priorities of European Union members will swing to promoting growth which implies more currency weakening [alongside the U.S. dollar].

We reiterate what we have pointed out before and that is that there is a reduction in systemic liquidity that demands freshly printed money to fill the gaps left by these deflationary influences. ECB President Mario Draghi gave banks more than €1 trillion ($1.31 trillion) of three-year loans in December and February. Until deflation is turned back to growth, this process will continue. As the oil price rises, so that deflationary influence persists, sucking money out of countries that import oil. The entire process is gold positive. More than that, the process itself throws doubts of the system’s ability to retain value or stability. Gold and silver become retreats from the uncertainty spawned by these dangers. There is no sign of a change in system needed to give currencies dependable values. [To get more of the right perspectives on the gold and silver markets and where gold and silver prices are going, subscribe through www.GoldForecaster.comorwww.SilverForecaster.com].

source: http://news.goldseek.com

Saturday, February 11, 2012

Prepare for Dollar Collapse

THE NOTION that the very same economic forces currently plaguing Greece et al are somehow not relevant to America does not hold water. As goes the rest of the world, so goes the US, writes Chris Martenson.

When we back up far enough, it is clear that money and debt are there to reflect and be in service to the production of real things by real people, not the other way around. With too much debt relative to production, it is the debt that will suffer. The same is true of money. Neither are magical substances; they are merely markers for real things. When they get out of balance with reality, they lose value, and sometimes even their entire meaning.

The US is irretrievably down the rabbit hole of deficits and debt, and that, even if there were endless natural resources of increasing quality available at this point, servicing the debt loads and liabilities of the nation will require both austerity and a pretty serious fall in living standards for most people.

Of course, the age of cheap oil is over. And as Jim Puplava says, the oil price is the new Fed funds rate, meaning that it is now the price of oil that sets the pace of economic movement, not interest rates established by the Fed.

However, of all the challenges that catch my eye right now, the one most worrisome is the shredding of our national narrative to the point that it no longer makes any sense whatsoever. I'm a big believer that our actions are guided by the stories we tell ourselves. To progress as a society, having a grand vision that aligns and inspires is essential.

But when words emphasize one set of priorities and actions support another, any narrative falls apart. At a personal level, if someone touts their punctuality but chronically shows up hours late, the narrative that says "this person is reliable" begins to fall apart.

Likewise, if a company boasts about being green but its track record belies them as a major polluter, the "green" narrative fizzles.

And at the national level, if we say we are a nation of laws, but the Justice Department selectively prosecutes only the weak and relatively powerless while leaving the well-connected and moneyed entirely alone, then the narrative that says "we are a nation of blind justice and equal laws" falls apart.

I wish this was just some idle rumination, but I see more and more examples validating the importance of alignment of narrative and behavior. Because when there is a disconnect between words and actions, anxiety and fear take root.

Unfortunately, there is quite a lot to fear and be anxious about in the most recent State of the Union address and GOP response.

The recent State of the Union speech by Obama, and its Republican response, are both remarkable for what they say as well as what they don't say. The summary is this: The status quo will be preserved at all costs.

Here are a few examples of the sorts of disconnects between rhetoric and reality that are absolutely toxic to the morale of all who are paying the slightest bit of attention.

Obama

Let's never forget: Millions of Americans who work hard and play by the rules every day deserve a government and a financial system that do the same. It's time to apply the same rules from top to bottom. No bailouts, no handouts, and no copouts. An America built to last insists on responsibility from everybody.

We've all paid the price for lenders who sold mortgages to people who couldn't afford them, and buyers who knew they couldn't afford them. That's why we need smart regulations to prevent irresponsible behavior.

It's time to apply the same rules from top to bottom? Is Obama aware of what Erik Holder is up to over there in the Justice Department? The robo-signing scandal alone has thousands and thousands of open and shut cases of felony forgery that can and should be applied to as many individuals as were directly involved, from top to bottom in every organization that was engaged in the practice.

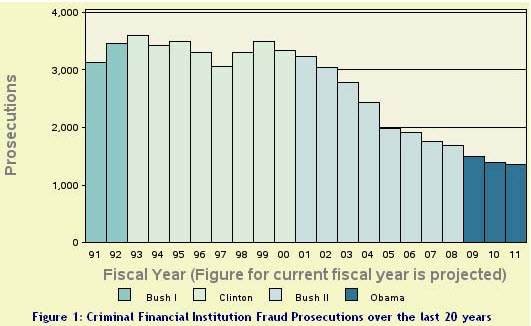

Here's the reality. Under Obama, criminal prosecution of financial fraud fell to multi-decade lows during what is and remains one of the most target-rich environments in living memory.

(Source)

Obama

And I will not go back to the days when Wall Street was allowed to play by its own set of rules.

So if you are a big bank or financial institution, you're no longer allowed to make risky bets with your customers' deposits. You're required to write out a "living will" that details exactly how you'll pay the bills if you fail – because the rest of us are not bailing you out ever again.

Has Obama checked with the Federal Reserve to assure they are on board with the new 'no bail out' policy? Because last I checked, they were the ones mainly involved in bailing out the big banks and providing swap lines and free credit to anyone and everyone that needed help, US or foreign.

To be fair, Obama can make no statement or claim about what the Federal Reserve can or can't or will or won't do. It is not under executive nor even legislative control. If, or I should say when, the Federal Reserve bails out the next bank or country or whomever, it's "the rest of us" who will be paying the bill – in the form of eventual inflation.

Obama

[W]orking with our military leaders, I've proposed a new defense strategy that ensures we maintain the finest military in the world, while saving nearly half a trillion Dollars in our budget.

Let's review the proposals for military spending then. The language above is nearly impossible to decode. What is really being said is that proposed defense increases have been scaled back, and that this is what is being called savings.

In 2000, Defense spending was $312 billion Dollars. In 2012, the proposed budget calls for $703 billion, a 125% increase in 12 years.

What the plan he mentions really calls for is spending increases in 5 out of the next 6 years. The lone holdout is 2013, when the plan calls for cutting spending by a whopping $6 billion less than the amount already approved for 2012.

Somehow that all translates into rhetoric that implies cuts of "nearly half a trillion Dollars."

As Lily Tomlin used to say, "As cynical as I am, I find it hard to keep up."

GOP Response

"The routes back to an America of promise, and to a solvent America that can pay its bills and protect its vulnerable, start in the same place. The only way up for those suffering tonight, and the only way out of the dead end of debt into which we have driven, is a private economy that begins to grow and create jobs, real jobs, at a much faster rate than today."

This platitude-laden set of ideas is blissfully blind to the role of energy in the story, the amount of debt in the system, and the fact that both parties have contributed equally over the years to the predicament at hand.

How exactly is it that the private economy is supposed to flourish here, with the Federal government borrowing more than a trillion Dollars a year and oil at $100 per barrel? The simple truth is that the US government needs to begin borrowing at a rate lower than the previous year's economic growth. If GDP grows at 2%, then the total debt pile must not grow by anything more than 2%. That is the only way that the official debts can shrink relative to the economy.

GOP Response

"We will advance our positive suggestions with confidence, because we know that Americans are still a people born to liberty. There is nothing wrong with the state of our Union that the American people, addressed as free-born, mature citizens, cannot set right."

Last I checked, the original vote tally in the Senate on the National Defense Authorization Act, which empowered the armed forces to engage in civilian law enforcement activities and selectively suspended the habeas corpus and due process rights (as guaranteed by the 5th and 6th amendments to the Constitution), passed by a voice vote of 93 to 7 in the Senate.

It's kind of hard to swallow the idea that the GOP stands with Americans as "a people born to liberty" when their members are in perfect lock-step with the Democrats, chipping away at the most basic and cherished freedoms. There's no difference between the parties when both seem intent on limiting individual freedom and increasing the power of the government to reach into and examine our daily lives.

The above examples are not meant to pick on any one person or party or set of ideas, but to illuminate the profound gap that exists between what we are telling ourselves at the national level and the actions we are undertaking.

Again, it is the gap between what we tell ourselves and what we do that creates a sense of unease, anxiety, and oftentimes fear. When we hear words "X" but see actions "Y" over and over again, it is hard not to come to the conclusion that the words are meaningless; empty rhetoric designed with polls and focus groups in mind, but little else.

It is the blind obedience to the status quo that worries me the most, as it raises the likelihood that nothing of any substance will be done until forced by circumstances, at which point, like Greece, we will discover that the remaining menu of options ranges from bad to worse.

In neither Obama's address nor the GOP response do we hear anything about Peak Oil, a stock market that has gone nowhere in ten years, or the fact that with two wars winding down there ought to be massive savings from defense cuts that we can capture. There's lip service to the idea of using more natural gas to begin weaning us off our imported oil dependence, but no commensurate trillion-Dollar program offered to rapidly build out the infrastructure necessary to utilize that gas in a meaningful way.

A more honest set of messages would note that mistakes were made, opportunities squandered, and priorities misplaced. It would note that the US is on an unsustainable course with respect to spending, debts, and liabilities. There would be an explicit admission that having your central bank print trillions in "thin air" money in order to enable runaway deficit spending is a dangerous and foolish thing to entertain.

Most obviously missing is a national narrative that is coherent and comports with the facts. Both parties basically imply that if we elect a few more of their type, do a little of this and then tweak a little of that, then we will get our nation back on track.

There is no call to a shared sacrifice for something greater. There is nothing to rally around except a laundry list of disconnected programs; a little something for everyone. There is no overarching theme under which everything else can be hung, such as a space race, a civil rights movement, or a massive upgrading of our national infrastructure.

A good narrative is one that inspires people and is based in reality but also asks something larger of us that we can share in. What is our vision for this country? Where do we want to be in ten years? How about twenty? How will we get there, and what will be required? What should we stop doing, what should we start doing, and what should we continue doing?

None of these things are on display, and all are badly needed if we are going to make the most of the next twenty years.

Of all the facts that got skimmed over or avoided in the State of the Union extravaganza, the fiscal nightmare in DC was probably the most glaring. Yes, both parties have decided to talk about the deficit, but neither is giving the appropriate context.

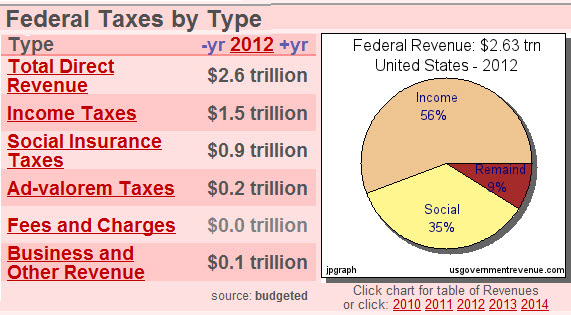

For FY 2012, the federal government is projected to run a $1.1 trillion deficit. Let's compare that number to the projected revenues:

(Source)

The $1.1 trillion deficit is 42% of total revenues and 73% of all income taxes. That is, in order to spend what the US currently spends without going further into debt (i.e., to have no deficit), income taxes must immediately increase by 73%(!).

This is the sort of territory that, were the US any other country, would have already landed its debt markets – and likely its currency, too – in very hot water.

Historically, countries that have run deficits 40% greater than revenue for more than two years have experienced profound financial and political crises. The US is now in its fourth year of inhabiting this rare territory.

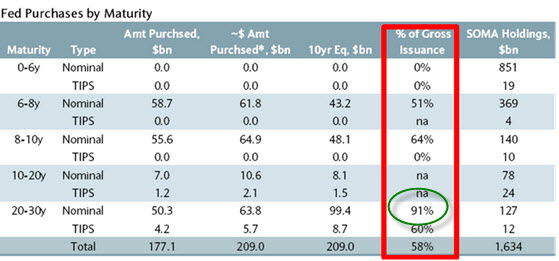

How can it keep doing this when every other country that has tried has gotten into trouble? Simple. The Federal Reserve has enabled such egregious deficit spending by buying up mind-boggling amounts of government debt. This has both kept rates low and created a lot of additional buying demand for Treasuries.

Exactly how much US debt is the Fed buying? Under Operation Twist, the Fed has bought anywhere from 51% to 91% of all gross issuance of bonds dated six years or longer in maturity.

(Source)

It is quite obvious that the Fed has been a major participant in the bond markets and a major reason why Treasurys are priced so high and offer so low a yield.

It seems that it is well past time to speak directly to the enormous fiscal deficits in a credible way, not merely bemoaning them being too high. And we're also overdue for an adult national conversation that it's unwise and unsustainable for a country to lean on its central bank to print up the difference between receipts and outlays.

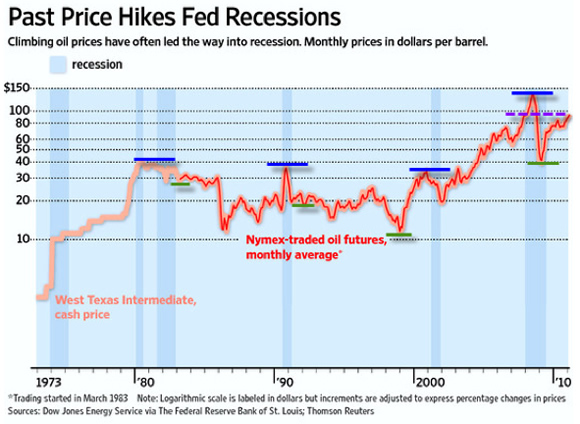

There is a clear relationship between high oil prices and recessions, confirming the idea that the price of oil has the same impact on the economy as higher interest rates (perhaps even more so nowadays). Both are a source of friction. With higher interest rates, less lending and less consuming happens. With a higher price of oil, more money gets spent on energy, much of it sent to foreign producers of oil, and thus less money is available for other consumption.

Both higher oil prices and higher interest rates cause people to think a bit more before pulling the trigger on either ordinary spending or a big capital project.

Note that all of the six prior recessions were preceded by a spike in oil prices. In the case of the double-dip 1980s twin recessions, oil remained elevated after the first recession was (allegedly) over. Don't be fooled by the logarithmic nature of the chart below – note that the typical decline in oil prices between the recession-inducing peak (blue lines) and the recovery-enabling trough (green lines) was a substantial 30%-50%:

(Source)

Also note in the most recent data that oil prices happen to be at roughly the same level that triggered the first recession in 2008 (the purple dotted line).

If we needed one simple chart to help us understand why trillions of Dollars of stimulus and handouts are not causing the economy to soar, this is the chart that explains the most. High oil prices and recessions are highly correlated, and it's not too much of a stretch to postulate that economic recoveries and high oil prices are inversely correlated.

Note also that the above chart is not inflation-adjusted. If it were, it would show that there have been exactly zero recoveries when oil prices are near or over $100 per barrel.

For those counting on an economic recovery here to lift all boats and assist the bailout efforts, the burden of history is upon them to explain why this time we should ignore the price of oil.

I say we cannot. Policy planners and citizens alike should be ready for disappointing market and economic activity in response to the usual bag of printing, borrowing and delaying tricks.

The State of the Union speech and GOP response neither accurately portray the true fiscal condition of the US, nor present a compelling narrative that speaks either to the realities of today or a future we might like to head towards.

The US is simply on a fiscally ruinous path, and neither party seems up to the task of laying out the story in a way that is mature, clear, and direct.

No recovery has ever been possible from oil prices this high, nor with debt levels this extreme, and it is quite improbable to think that both conditions could be overcome with anything less than a completely clear-eyed view of the true nature of the predicament faced.

Decades ago, Ludwig Von Mises captured everything discussed here elegantly:

There is no means of avoiding the final collapse of a boom brought about by credit expansion.

The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

Our current dire fiscal condition, our leaders' dysfunctional unwillingness to address the flawed behavior that caused it, plus many other recent events both in the US and in Europe, point to the idea that a voluntary abandonment of further credit expansion is just not on the menu.

That leaves us with some final and total catastrophe of the involved currency system(s) as the inevitable outcome.

Source: http://goldnews.bullionvault.com

Sunday, January 8, 2012

Gold prices may touch $ 2,000 an ounce in 2012: Study

NEW DELHI: Gold prices are likely to increase for the third consecutive year and would touch a record high of USD 2,000 an ounce in 2012, said a survey.

According to the annual London Bullion Market Association (LBMA) survey which covered 26 precious metal analysts, the average forecast for the precious metal for 2012 is USD 1,766 per ounce.

The average forecast for gold this year (USD 1,766 per ounce), a 12.34 per cent rise from average price in 2011 and a 10.2 per cent increase compared to the price in the first week of January, 2012.

Out of the 26 contributors to the survey, 19 expect gold to cross the USD 2,000 per ounce level in 2012.

Gold soared to an all time high in 2011 on strong demand as precious metals are considered as a 'safe-haven investment' in times of economic turmoil and rising inflation.

In India, gold (99.5 per cent purity) crossed the Rs 29,000 per 10 grams-level to a historic high of Rs 29,155 per 10 grams in December, 2011 (one ounce equals to 28.35 grams).

While analysts predict a jump in gold prices and expect it to hit record high levels, they are not so optimistic about other precious metals like silver, palladium and platinum.

"If we compare the average 2012 forecasts with actual average prices in 2011, we can see that analysts are less bullish about the prospects for precious metals (excluding gold) during the next 12 months," LBMA Commercial Director Ruth Crowell said.

Whilst analysts predict a rise in the price of gold (12.3 per cent) and price of palladium to remain broadly unchanged (0.3 per cent).

They are forecasting a fall in the price of both silver (-3.2 per cent) and platinum (-5.6 per cent).

Silver (.999 fineness) prices hit an all-time high of Rs 75,020 per kg on April 25, 2011, on heavy speculative and investment-driven buying in line with global markets, where the metal rose to a fresh 31-year high.

The LBMA is the international trade association that represents the wholesale over-the-counter market for gold and silver.

The aim of the LBMA Forecast survey is to predict the average, high and low price for each metal as accurately as possible.

According to the annual London Bullion Market Association (LBMA) survey which covered 26 precious metal analysts, the average forecast for the precious metal for 2012 is USD 1,766 per ounce.

The average forecast for gold this year (USD 1,766 per ounce), a 12.34 per cent rise from average price in 2011 and a 10.2 per cent increase compared to the price in the first week of January, 2012.

Out of the 26 contributors to the survey, 19 expect gold to cross the USD 2,000 per ounce level in 2012.

Gold soared to an all time high in 2011 on strong demand as precious metals are considered as a 'safe-haven investment' in times of economic turmoil and rising inflation.

In India, gold (99.5 per cent purity) crossed the Rs 29,000 per 10 grams-level to a historic high of Rs 29,155 per 10 grams in December, 2011 (one ounce equals to 28.35 grams).

While analysts predict a jump in gold prices and expect it to hit record high levels, they are not so optimistic about other precious metals like silver, palladium and platinum.

"If we compare the average 2012 forecasts with actual average prices in 2011, we can see that analysts are less bullish about the prospects for precious metals (excluding gold) during the next 12 months," LBMA Commercial Director Ruth Crowell said.

Whilst analysts predict a rise in the price of gold (12.3 per cent) and price of palladium to remain broadly unchanged (0.3 per cent).

They are forecasting a fall in the price of both silver (-3.2 per cent) and platinum (-5.6 per cent).

Silver (.999 fineness) prices hit an all-time high of Rs 75,020 per kg on April 25, 2011, on heavy speculative and investment-driven buying in line with global markets, where the metal rose to a fresh 31-year high.

The LBMA is the international trade association that represents the wholesale over-the-counter market for gold and silver.

The aim of the LBMA Forecast survey is to predict the average, high and low price for each metal as accurately as possible.

source: http://economictimes.indiatimes.com

Saturday, December 24, 2011

Buying Silver Is Like Buying Gold At $554 Today

I think that buying silver today is like buying gold for $554 an ounce. Let me explain: As I am writing, silver is currently trading at about 65.2% (32.6/50) of its 1980 high. If gold was trading at 65.2% of its 1980 high, it would be trading at $554 (0.652*850).

Now, I really like gold, even at today’s price of $1 738, but why should I pay $1 738, if I can get it for $554 by buying silver and then exchanging it for gold when the gold/silver ratio is at an extreme (in favour of silver). The reason for this logic comes from the fundamental relationship between gold and silver as explained in my previous article.

For my argument to be valid, silver has to outperform gold over my investment period, and at least equal gold’s performance relative to its 1980 high. That is, for example, if gold reaches five multiples of its 1980 high ($4250), then silver should do the same ($250), in this example, giving us a gold/silver ratio of 17.

Now, if silver outperforms gold, then that means that the gold/silver ratio should decline over my investment term. In my previous article called: Why Silver for a Monetary Collapse, I analysed the gold/silver ratio from a very long perspective (200 years). Here I would like to take a slightly more short-term view (40 years).

Below, is a long +/- 40 year chart of the gold/silver ratio:

On the chart, I have identified two fractals, which I have both marked with points 1 to 3. The two patterns are visually very similar. I have indicated two option of where we could be currently (on the current pattern), compared to the 70s pattern. The ratio appears to be at a major crossroads, ready to make a big move, up or down. This could means that a massive move in the gold and silver price is due shortly.

Based on the patterns, if it moves up, it would likely signal the end of the precious metals bull market, similar to January 1980. A move down would be an acceleration of the current bull market in gold and silver, similar to August/September 1979.

The question is therefore: Do you think the bull market in precious metals is over? Before you answer that, first consider the following:

On the above graphic, the top chart is the current gold bull market from 1999 to date, compared to the bull market of the 60s and 70s, the bottom chart. The previous bull market in gold was about 14 years long, from a peak in the Dow/gold ratio to the bottom in Dow/gold ratio. The current bull market is 12 year old, from the peak in the Dow/gold ratio to date.

The previous bull market ended with a parabolic move in gold (on the above scale). The current bull market has not made a parabolic move (on the above scale); in fact, it has been rising steadily over the last 12 years.

To me, these two charts suggest that we are more likely to have a parabolic rise in the gold price, than being at the end of this bull market. Therefore, it also suggests that price action for gold and silver, and the gold/silver ratio is likely to be more like 1978/1979 than like January 1980.

So, back to my argument of buying silver, in order to get gold at $554: I certainly think that silver will outperform gold over the remaining part of this bull market in precious metals, as well as, at least equal gold’s performance relative to its 1980 high. I can certainly see how gold could be at $4250 with silver being at $250, or at higher prices, with the gold/silver ratio being at 17 or less.By: Hubert Moolman

source: http://news.silverseek.com

Tuesday, November 1, 2011

Gold Update

As Governments Continue to Perpetuate the Chaos that is Already Occurring in the Currency Markets, Make Sure You Own Some Gold.

The price of gold pushed through and held above the key resistance level of $1700 an ounce last week, as the US dollar dropped sharply due to the euphoria from Europe about the agreement made at the Euro Summit in Brussels. No one was more excited about the outcome than French president, Nicolas Sarkozy, who seems determined to save the world. I wouldn’t be surprised if he puts on a Superman costume every night before going to bed and I am sure he is saving himself and not the rest of the world.

With regard to the recent summit in Brussels the key issues agreed on were, that the euro currency remains at the core of the European project of peace, stability and prosperity. The leaders also outlined certain steps that have to be taken in order to solidify the economic union. And, commensurate with the monetary union, they agreed on certain key issues.

They all agreed that the Greece’s debt to GDP ratio with should decline to 120% by 2020. They also agreed that the European Financial Stability Facility (EFSF) resources can be leveraged. The leverage could be up to 4 or 5, which is expected to yield around 1 trillion euro (around 1.4 trillion dollar).

It was also agreed that it was necessary to raise confidence in the banking sector by (i) facilitating access to term-funding through a coordinated approach at EU level and (ii) the increase in the capital position of banks to 9% of Core Tier 1 by the end of June 2012.

The agreement also included a deal between Eurozone leaders and banks to force private investors to take a 50% loss or "haircut", slicing 100 billion euros off the 350-billion-euro debt pile hampering Greece.

There was also an unequivocal commitment to ensure fiscal discipline and accelerate structural reforms for growth and employment.

As far as I am concerned the deal clinched in Brussels offers nothing but a short-term reprieve and is unlikely to be enough to stop the crisis from spreading in the long run. Now, governments can’t even afford to service their own debts without having to resort to trickery such as suspending “mark-to-market” accounting rules and printing more money to buy their own bonds (effectively a Ponzi scheme). Frankly, all they are doing is perpetuating the chaos that is already occurring in the currency markets.

According to Jim Rogers, a world-renown commodity advisor, who has been consistently correct about precious metals since the beginning of the bull market in 2001. "Politicians have delayed addressing the problem yet again."

"It will come back in a few weeks or a few months and the world will still have the same problem, but this time only worse because the European Central Bank and other countries will be in deeper in debt."

Rogers reiterated that widespread haircuts across Europe are necessary to truly resolve the crisis. "Greece is bankrupt, but others are too, and these haircuts will have to come back and be wider," he says, adding that this morning's global stock market rally had the potential to last for a while.

"There has been a major overhang, so we will see the easing of some pressure, but the problem will come back because the Western world still has not dealt with its debt," says Rogers.

"Most European countries are increasing their debt rather than decreasing their debt. Until that changes, the problems are going to continue, just as they will in the U.S.," he added.

Even though global markets surged after the summit deal was announced, contagion in Spain and Italy remain a real risk. Italy’s debt alone is €1.8 trillion which in itself is larger than the €1 trillion bailout fund. And, their 10 year bond has risen to close to 6% in recent days.

The deal "has the merit of validating a European framework, not to resolve the debt crisis, but at least reassures and (tries) to convince markets of Europe's collective will," said Barclays Bourse analyst Frankin Pichard.

The crisis that started in Greece two years ago has successively hit Ireland and Portugal and threatened to spill over to the euro area's third and fourth economies, Italy and Spain.

"The next meeting on November 3-4 (at the G20 summit in Cannes) should provide more details on how the new formula EFSF will function," said Pichard.

"We're also waiting for further indications on states' credibility, notably Italy and France, concerning their ability to reduce their budget deficits. Chaos has been distanced but the path is still long before crying victory."

The head of the European bailout fund Klaus Regling said that he expects the Eurozone's economic problems will last two to three years, and long-term issues will remain. Regling's remarks suggest Europe still faces a long road to recovery from its sovereign-debt crisis.

"I think the European problems will be well-tackled and overcome over the next two to three years," Dow Jones quoted Regling as saying during a talk at Beijing's Tsinghua University.

"But it does not mean that all problems in this world will have disappeared," the chief executive of the European Financial Stability Facility (EFSF) said.

Longer-term challenges include: a "big structure shift in financial markets" caused by the damaged appeal of sovereign debt among investors, and boosting competitiveness in some countries, Regling said.

"Sovereign debt, which for decades or centuries was the predominant risk-free asset, may be losing that status, not only in Europe but also in other countries," he said.

Far from gold being in a bubble, the real bubble is the Eurozone, US and global debt bubble which is unravelling right in front of us. And, as central bankers try to manipulate the markets in attempt to escape the inevitable, the outcome will be a massive financial collapse just as Ludwig von Mises once stated:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Japan intervened in the currency market on Monday morning for the third time this year, sending the U.S. dollar and the euro climbing sharply against the currency. The intervention came after the dollar touched a record low of 75.31 yen and pushed the world's main reserve currency up past 79 yen within two hours.

"We started currency intervention this morning in order to take every measure against speculative and disorderly moves and to prevent risks to the Japanese economy from materializing," Prime Minister Yoshihiko Noda told parliament.

Noda, who took over as Japan's sixth premier in five years last month, served as finance minister in the previous cabinet and led three past interventions between September 2010 and August, including joint action with G7 partners in March 2011. The September 2010 intervention was Japan's first in six years.

Azumi said that while Japan acted solo on Monday, he remained in close contact with his international counterparts.

As central banks print more money to pay, the outcome is going to be a further depreciation of the major currencies, an escalation in global currency wars, increased capital controls, exchange controls, tariff hikes etc. All of this action is going to cause more volatility and uncertainty in global financial markets as well as an increasing loss of confidence in fiat currencies. And, as this happens, more individuals will turn to gold and silver to protect their wealth. Gold has always been the oldest form of sound money. It has endured countless economic collapses and has retained its purchasing power through the decades. On the other hand, every single fiat currency has ended in failure.

Both the FOMC and the ECB meet this week, and neither is expected to make changes to short-term interest rates. FOMC members Tarullo, Yellen, and Dudley made dovish comments a week ago which suggested that QE3 was a possibility in the long-run but gave no indication that changes would be made at this week’s meeting. Given the 2.5% growth in US GDP reported last week, the Fed appears to have some breathing room.

The ECB had been expected to make a 25 bps rate cut several weeks ago. However, that may also be pushed back in the wake Thursday’s agreement on Greek debt and bank recapitalization. Some expectations now put the next ECB rate hike into December.

In the meantime, I remain extremely bullish on gold and urge investors to accumulate or add gold to their investment portfolios.

TECHNICAL ANALYSIS

The recent break of $1700/oz (R) suggests that gold prices are gaining upward momentum and that a bottom of the correction was posted at $1600/oz. However, I would like to see prices remain above this level for at least another week before I declare this a decisive break.

By: David Levenstein

source: kitco.com

Wednesday, October 26, 2011

John Taylor says Gold to Top $1,800 by November

source: http://goldnews.com

John Taylor, the famous manager of the world’s largest hedge fund, FX Concepts, has come out with his recent view for gold and currencies.

Taylor believes the markets are ready for another risk rally into November which will ultimately fall off sharply. Through this rally, gold prices may reach $1,800/oz again, according to Taylor which should coincide with risk currencies rallying as well. Taylor’s views align with some other major traders as a recent Bloomberg survey indicated that 22 out of 25 traders are bullish on the metal at present. In addition central bank and fund buying is likely to ensue as prices have fallen recently, an event predicted by famed trader Marc Faber. As late November approaches, however, Taylor and his firm see the next of leg of an economic downtrend emerging and gold will not be unscathed in his view. Taylor explains in his recent weekly market insight report,

“…excessive debt built up during the good times must be paid back, investors are forced to sell assets and drive down financial markets. The liquidation even hits ‘safe’ investments like gold.”

The metal could fall as low as $1,000-$1,200 an ounce, by the end of the first quarter of 2012, according Taylor who then advocates buying the metal with both hands. If the metal drops,

“I think it’s probably a big buy… There’s nothing to stop it from going up. Monetary systems are grotesquely screwed up, especially in Europe and also in the U.S. There’s going to be an awful lot of confusion going on for the next decade.”

Taylor says.

Gold prices are down more than -1% today, holding steadily above $1,600 per ounce however. The metal hit a high of $1,921/oz last month before dipping back sharply to $1,532/oz where it entered a major support range:

Sunday, October 2, 2011

Don't Panic on Metal Tumble

Fall officially began on September 21, but it's not just leaves that are cascading downward. In the few market days of the new season, precious metals prices have seen significant drops, some 11% for gold and 31% for silver. In its lurch downward, gold plowed through support levels at $1,750, $1,700, and $1,645 an ounce. I'm sure many readers are concerned.

After all, by the time gold put in its recent peak on August 22, it had logged a stunning 44% appreciation in calendar year 2011. And even after its recent tumble, the metal is still 22% higher than it was on January 27, the 2011 low. Therefore, some may conclude that gold has further to fall, and that the descent could be steep.

Given this anxiety, it might be helpful to summarize some factors we see impacting prices. Emotions loom large in the financial world, and it is easy to lose one's focus during periods of uncertainty. From as rational a perspective as I can gain during these irrational times, here is my view on why precious metals have recently pulled back so violently:

Market Technicals. Given the swift rise of gold and silver during the first half of 2011, precious metals were due for a correction - especially following the parabolic increases that we saw in August. Markets never go up in a straight line, and often the biggest downward movements occur in bull markets. These sharp movements are common in gold, especially during short periods of financial panic. For instance, gold fell more than 25% in the second half of 2008, and almost 15% from February to April 2009. Yet after the dust settled in those earlier corrections, gold resumed its upward march with even more gusto.